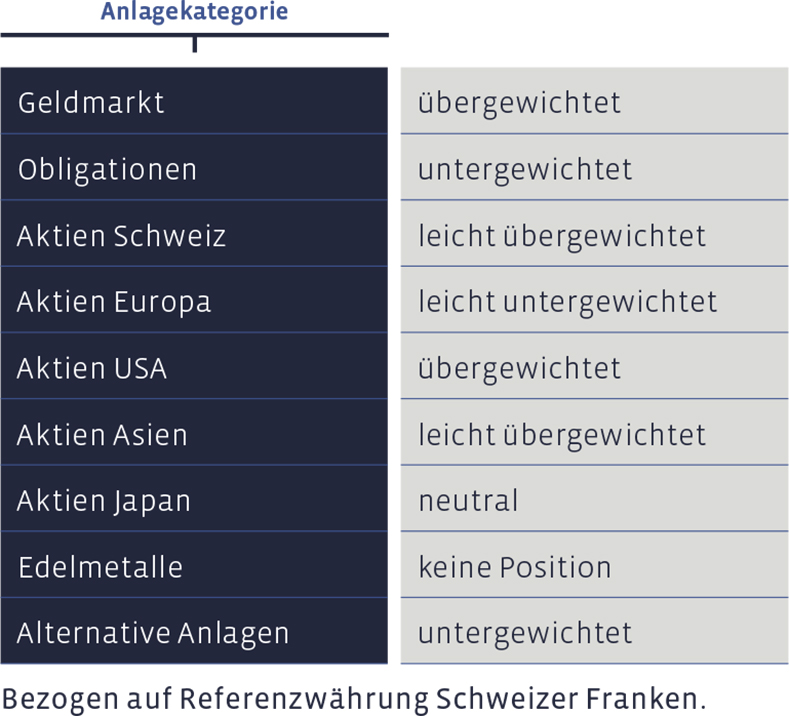

An unserer letzten Anlagekomitee-Sitzung Mitte September haben wir die folgende Asset Allokation eines ausgewogenen Schweizer-Franken-Portfolios mittlerer Risikostufe, ohne kundenseitige Einschränkungen, beschlossen. Mandate in anderen Referenzwährungen weisen teilweise abweichende Veränderungen und Gewichtungen auf. Diese können bei Ihrem Kundenberater gerne nachgefragt werden.

Geldmarkt

Wir halten in unseren ausgewogenen Portfolios taktisch eine erhöhte «Cash-Quote». Dies geht einerseits aufgrund mangelndem Renditevorteil zu Lasten der CHF-Obligationenquote und andererseits zu Lasten der alternativen Anlageklasse.

Obligationen

USD-Obligationen bleiben wegen der höheren Verzinsung gegenüber ihren Pendants in CHF mit einem Renditeaufschlag von knapp 3% attraktiv. Wir behalten eine 4%-Quote in diesem Segment als Bestandteil der Asset Allokation bei. Die Obligationen in CHF haben von der Zinssenkung durch die SNB profitiert, Neuanlagen verlieren nun aber auf diesem Renditelevel an Attraktivität. Als Beimischung und zur Ertragssteigerung setzen wir in dieser Anlageklasse auf zwei Spezialfonds, welche mit einer deutlichen Überrendite seit Jahresbeginn überzeugen.

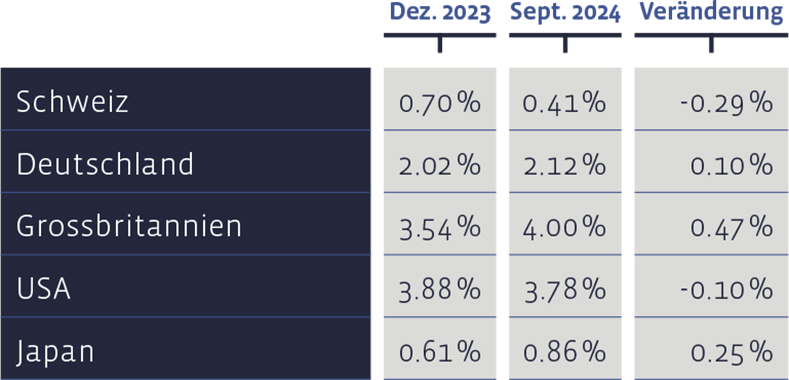

Seit Jahresbeginn entwickelten sich die Renditen zehnjähriger Staatsobligationen unterschiedlich:

Aktien Schweiz

Der Swiss Performance Index (SPI) stieg über den letzten Dreimonatszeitraum betrachtet um 2,0%. Unsere nach Value-Kriterien zusammengestellte Aktienauswahl, das „Swiss Stock Portfolio“ (SSP), weist im dritten Quartal ebenso eine Gesamtperformance (Kursveränderungen plus Dividenden) von 2,0% aus und lag damit auf Augenhöhe mit seiner Benchmark. Wir halten im Vergleich zur Benchmark ein grösseres Gewicht an Schweizer Aktien aus dem Small-/Mid-Cap-Segment, was dazu führt, dass üblicherweise Abweichungen zum SPI auftreten.

Besonders erfreulich haben sich im zurückliegenden Quartal im SSP die Papiere von Siegfried (+22%), DKSH (+11%) und Lonza (+9%) entwickelt. Die Schlusslichter bilden Forbo (-17%), EFG (-14%) und Tecan (-7%).

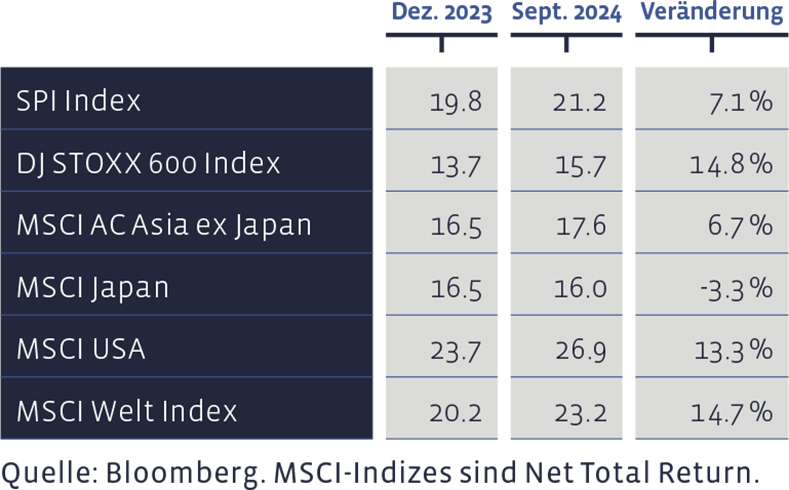

Die Kurs / Gewinn-Verhältnisse, aufgrund der letztbekannten Gewinne für zwölf Monate, sind fast überall gestiegen:

Langfristig präsentiert sich die Entwicklung des SSP sehr gut. Seit 2012 beläuft sich die durchschnittlich jährliche Performance auf 10,31%, womit die mittlere Benchmark-Performance von 8,42% deutlich übertroffen wird. Seit 2012 hat diese Strategie eine kumulierte Gesamtperformance von rund 285% erreicht, der Index eine von 204%. In den SSP-Zahlen sind Transaktionskosten abgezogen, wogegen der Vergleichsindex kostenfrei kalkuliert ist.

Aktien Europa

Die seit Mitte Mai festgestellte Seitwärtsbewegung des europäischen Gesamtmarktes fand mit den allgemeinen Verwerfungen anfangs August ein abruptes Ende. Mit einem starken Rebound konnten im September jedoch neue Jahreshöchstwerte erreicht werden. Per Quartalsende beläuft sich das Plus des umfassenden Stoxx 600 Europe NR auf +2,6%, der Euro Stoxx 50, mit den 50 grössten Aktien aus dem EUR-Währungsraum, stieg um 2,4%. Im dritten Quartal waren unter den europäischen Aktien jene aus Spanien am meisten gefragt. Der IBEX in Madrid stieg um 9,5%.

Wir haben unserer europäischen Aktienauswahl Siemens, LVMH, Novo Nordisk, DSM-Firmenich und ASML beigefügt und sind mittels entsprechender EtF-Positionen zwei taktische Positionen in europäischen Large-Caps sowie Schweizer Aktien eingegangen. Unsere europäische Titelauswahl, das «European Stock Portfolio» (ESP), konnte trotz der erwähnten taktischen Anpassungen den im ersten Halbjahr eingehandelten Rückstand zur Benchmark noch nicht wettmachen. Im 3. Quartal gewinnt das ESP zwar +1,15%, bleibt aber hinter dem Vergleichsindex zurück.

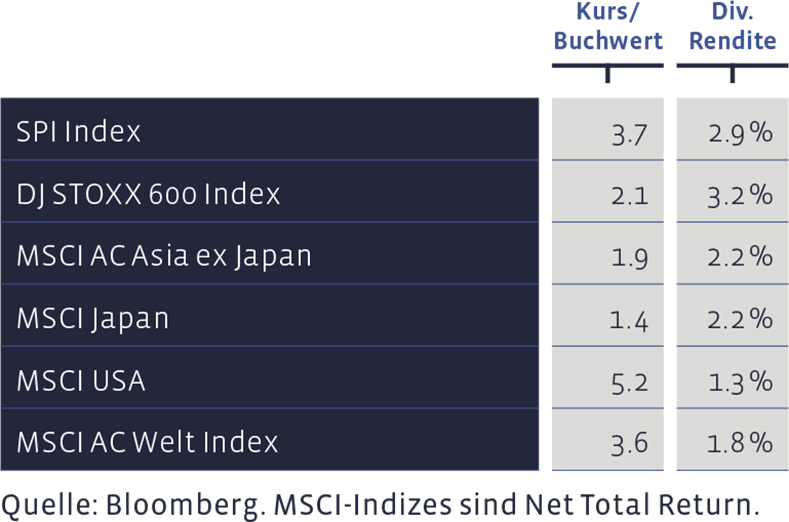

Kurs / Buchwerte und Dividendenrendite wichtiger Aktienmärkte:

Zu den besten Titeln des ESP zählten im letzten Quartal Tesco, DSM Firmenich (je +17%) und Sanofi (+14%). Am schlechtesten schnitten ASML (-23%), Novo Nordisk (-21%) und Gerresheimer (-20%) ab. Die Zahlen sind in den jeweiligen Heimwährungen angegeben.

Die langfristige Performance des ESP seit 2004 weist eine jährliche Durchschnittsrendite von 6,62% auf, verglichen mit 6,95% der Benchmark. Kumuliert sind so im Portfolio seit 2004 insgesamt 278% zusammengekommen, wogegen die kumulierte Index-Performance auf 303% zu stehen kommt. In den Zahlen für das ESP sind überdies Transaktionskosten und Quellensteuern abgezogen, während der Referenzindex ohne Kosten kalkuliert wird.

Die Entwicklungen von SSP und ESP können stets auch auf unserer Webpage www.salmann.com verfolgt werden und zwar im Bereich «Anlagestrategien».

Aktien USA

Auch im dritten Quartal überzeugte die Entwicklung des US-Aktienmarktes. Die US-Aktien, zusammengefasst im S&P500 Index, legten in der Betrachtungsperiode um 5,9% zu. Die fundamentalen Bewertungen (z.B. Kurs / Gewinnverhältnis) bewegen sich über den zehnjährigen Durchschnittswerten. In der Markttechnik sticht das starke Momentum des amerikanischen Marktes heraus. Am besten laufen Aktien aus den Sektoren Technologie, Finanz und Kommunikation. Wir halten an der taktischen Übergewichtung in US-Aktien fest.

Aktien Asien (ohne Japan)

An den Anlagen vom asiatischen Festland haben wir seit unserer letzten Berichterstattung keine Veränderungen vorgenommen. Neben unserer langjährigen Position im Aktienfonds Barings Asean Fund, welcher Aktien aus aufstrebenden Ländern Südostasiens enthält, sind wir mittels zweier Länderfonds in indische sowie vietnamesische Aktien investiert. Wir haben hohe Kursanstiege in Südostasien im 3. Quartal gesehen, der indische Aktienmarkt boomt richtiggehend. Auch der vietnamesische Aktienfonds hat einen positiven Renditebeitrag geliefert.

Aktien Japan

Der japanische Aktienmarkt gehörte bis zur Jahresmitte zu den Besten weltweit. In diesem Jahr begann die japanische Notenbank die Leitzinsen zu erhöhen, was zur Aufwertung des Yens und im gleichen Zug zu heftigen Verwerfungen an der japanischen Aktienbörse anfangs August geführt hat. Mittlerweile haben sich die Aktienkurse im Land der aufgehenden Sonne stabilisiert. Trotzdem weist der TOPIX Index im vergangenen Quartal eine negative Rendite von 5,0% aus. Wir haben uns entschieden, die Gewichtung unserer Allokation in Japan auf neutral abzubauen und Kursgewinne mitzunehmen.

Alternative Anlagen

Wir sind im Moment nur im AXA Cat Bonds Fund investiert und in Alternativen Anlagen untergewichtet. Der Fonds investiert in Anleihen, welche klar definierte Schadensereignisse aus Naturkatastrophen rückversichern. Dieses Anlagesegment verfügt aktuell über ein attraktives Prämien-Risikoverhältnis.

Unsere Asset Allokation zusammengefasst:

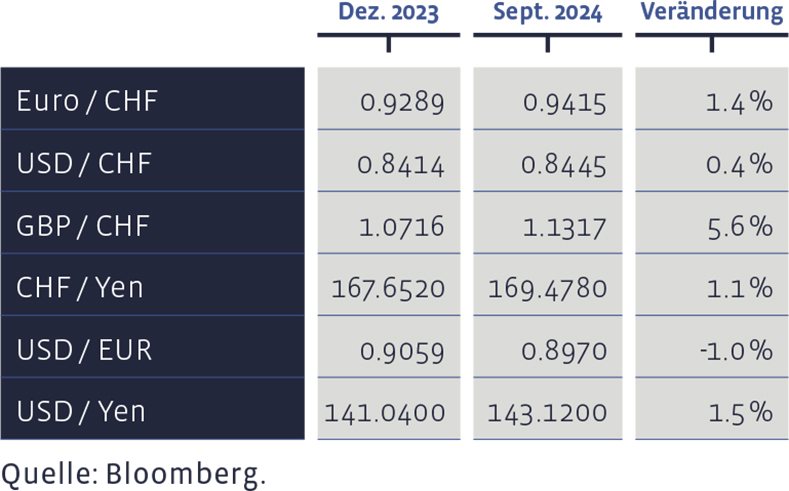

Seit Anfang Jahr haben sich ausgewählte Devisen-Kurse wie folgt entwickelt: