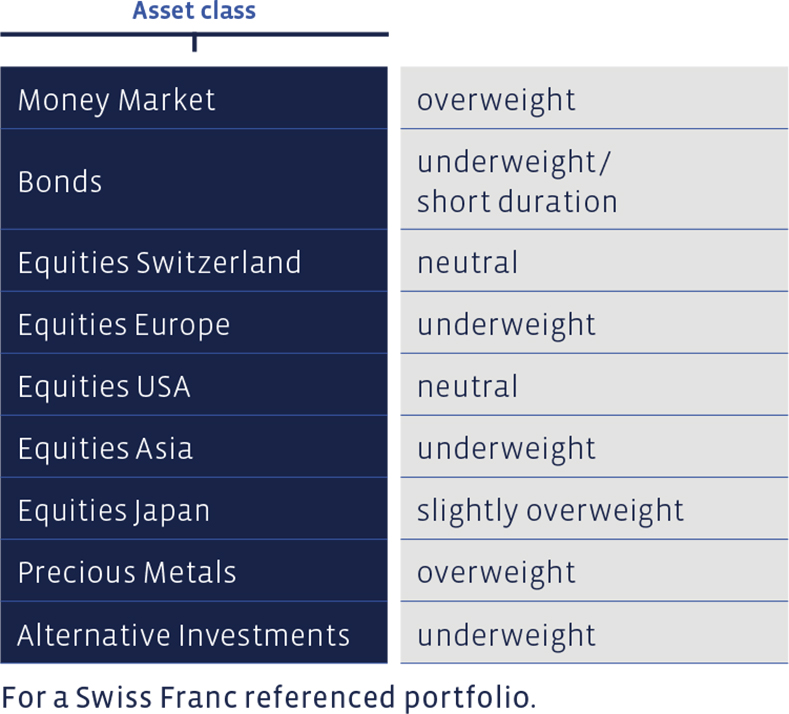

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions (mandates in different reference currencies at times display different nominal weightings and weighting changes).

Money Market

The money market allocation remained at slightly elevated levels throughout the second quarter and with that remains overweight. We are keeping some powder dry here, to be able to benefit as and when opportunities present themselves.

Bonds

We did not initiate any active changes to the inventory and remain underweight in this sector.

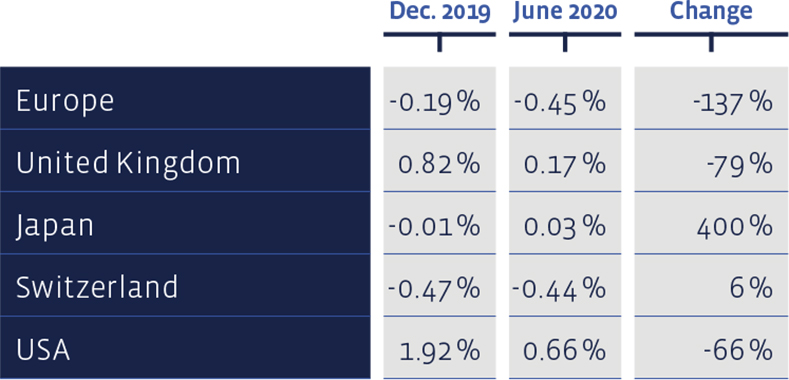

During the course of the year, yields on 10-year government bonds declined almost everywhere:

Equities Switzerland

Swiss equities recovered markedly during the second quarter. The performance of the directly invested “Swiss-Stock-Portfolio” (SSP) came in with -7.12% for the first half-year, that of the benchmark Swiss Performance Index (SPI) at -3.13%. The benchmark benefitted from the high weightings of its top components Nestlé, Novartis and Roche, which, although also contained in the SSP, are lower weighted there. The “Strategy Certificate linked to the SIM Swiss Stock Portfolio Basket” (Valor: 36524524, ISIN: CH0365245247) based on the SSP declined by 8.5% during the first half-year.

In the long term, the performance of our value-criteria driven selection is quite presentable. Since 2012, the average annual performance of the SSP amounts to 13.7%, a result that beats the average benchmark’s performance of 10.5% markedly. Since 2012, the total cumulative return of this strategy amounts to about 198%, while that of the index to 133%. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

As every spring, we completed the regular annual rebalancing during the second quarter. In the process, the most attractive names of the Swiss market either are added, or remain in the portfolio, whereas the least attractive ones are sold. Even more so than in previous years, the emphasis in stock selection was on high quality. As part of the rebalancing, all components’ weightings were adjusted. These adjustments apply equally to the direct investments in clients’ portfolios, as well as to the composition of the certificate.

New to the selection are the stocks of Alcon, Emmi, Lafargeholcim and Vifor Pharma, whereas Autoneum, Metall Zug, Orior as well as Ypsomed have had to make way. Adecco, Also, Baloise, Bell Food, Cembra Money Bank, Coltene and Helvetia Holding remained in this selection of domestic stocks unchanged. Nestle, Novartis and Roche also defended their positions. The same goes for Siegfried, Sonova, Swatch, Swisscom, Swiss Life, as well as Vetropack.

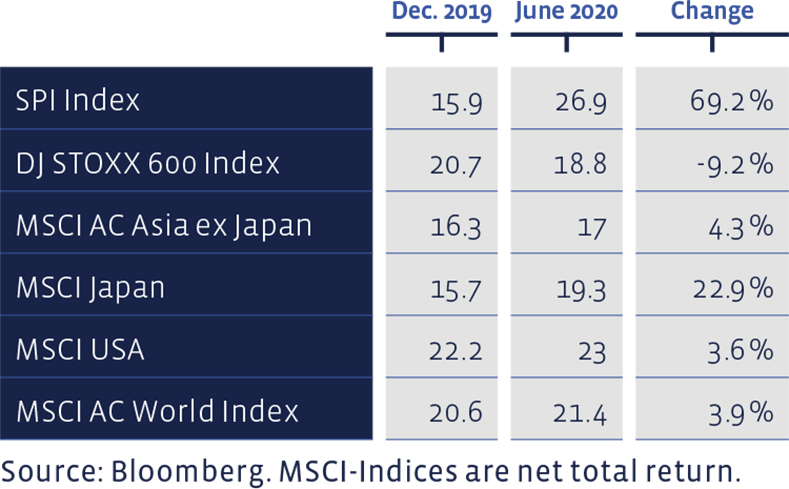

Measured on the price/earnings ratio using the latest 12 months profit figures, nearly all equity markets have become more expensive since the beginning of the year:

Equities Europe

Our value-style centric, directly invested “European Stock Portfolio” (ESP) managed to recover more than 20% during the second quarter and beat the index during that period. Nevertheless, it suffered a loss of 13.8% during the first half of the year, measured in Euro. The broad Dow Jones Stoxx 600 Index achieved -12.1% (price change plus dividends) during the first half-year. The value-style driven Dow Jones Stoxx 600 Value Index, however, stood at -21.3% at the end of June.

In the long term, the ESP displays a marked outperformance against the broad index. Since 1993, the ESP has returned on average 7.8%, compared to the 6.5% achieved by the benchmark. The transaction costs, as well as taxes withheld, are deducted in ESP figures, whereas the index is calculated without bearing any costs. The cumulative performance of the ESP since 1993 amounts to about 757%, while that of the benchmark to about 500%.

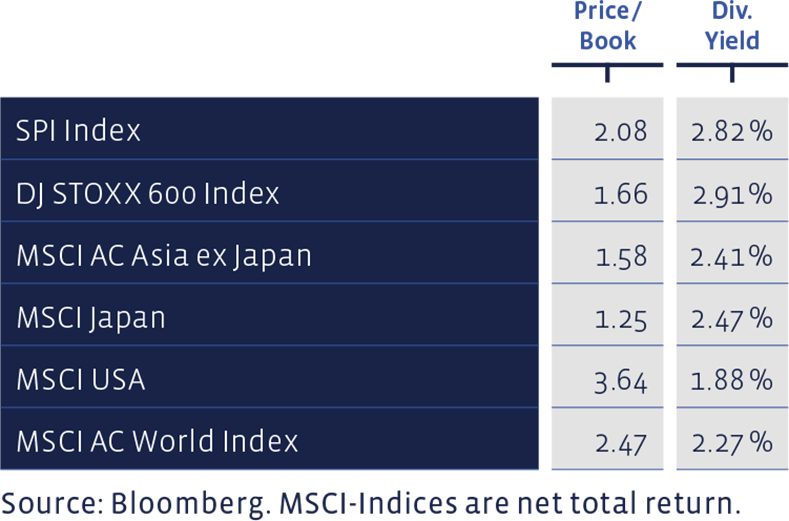

Price/Book and Dividend Yield of major equity markets:

The European Stock Portfolio also underwent its regular annual revitalisation. New names amongst the most attractively valued stocks are Enagas and Neste (Energy sector), as well as the utility, Terna. Nokian Renkaat, Swatch and Taylor Wimpey also made it on the list. In the technology sector, the new names are ASM International, as well as Dialog Semiconductor. IG Group (Financials) as well as the Chemical and Pharma stocks, Diasorin, Fuchs Petrolub and Recordati round off the list of new additions.

A2A, Aurubis, Amsterdam Commodities, Barratt Developments, British American Tobacco, Covestro, Hikma Pharmaceuticals, as well as Jupiter Fund Management, held on to their places in the selection of Europe’s 25 most attractively valued stocks. The same applies to Legal & General, Persimmon, Randstad, Siltronic and Tate & Lyle. Whereas Babcock International, Repsol, Saras, SKF, Renault, Sopra Steria, Software AG, CNP Assurance, Nordea Bank, Fresenius Medical Care, UCB und Arkema were dropped from the portfolio.

Equities USA

American equities were amongst the high-flyers of the second quarter this year. The Performa US Equities Fund employed by us even bettered this by clearly beating its benchmark in the year to date. During the course of the past quarter, we sold part of the US equity allocation that before had been overall overweight and reduced the position to neutral weight. In return, we bought units of State Street Global Advisors’ SPDR MSCI World Energy ETF.

Stocks of the energy sector suffered a massive setback as demand plunged. The energy sector is amongst the most battered sectors of the crash. At the peak of the crisis, energy stocks were trading at discounts to the overall market never before seen, as well as being fundamentally valued at extremely low levels. With a recovery in economic activity, oil and gas prices are likely to recover and heave stocks in the industry to a higher level. We view this purchase as a tactical engagement of limited duration, not as a long-term strategic one.

Equities Asia (excluding Japan)

Equities of the Asian-Pacific region managed a recovery that during the second quarter almost reached the magnitude of the top-performers America and Germany. Other emerging countries achieved slightly less impressive progress. The engagement in this sector remained unchanged throughout the reporting period, which is to say we continue to be underweight.

Equities Japan

Slightly above neutral weight is the unchanged position in Japanese stocks, which pulled clear of March’s lows in lockstep with other markets.

Alternative Investments

Alternatives proved themselves as relatively low volatility investments during the crisis. Since the reduction in March, we have not initiated any further changes and with that maintained our underweight position.

Precious Metals

Gold outshone everything in the second quarter too. During the past three months, the price per ounce in US Dollar has climbed by nearly 13%, and since the start of the year, this amounts to a cumulative of about 17%. The gold ETF moved in similar dimensions. We left the position unchanged, which corresponds to an overweight position.

Summary of our current Asset Allocation: