The Investment Committee sat frequently and at close intervals during March, continuously monitoring the situation. At these meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions (mandates in different reference currencies at times display different nominal weightings and weighting changes).

Money Market

The money market allocation increased slightly during the first quarter and is now overweight. During March, we sold part of the alternative asset allocation, which had held up rather well during the storm, to raise some cash for potential additions to the equity allocation.

Bonds

We did not initiate any active changes to the inventory and remain underweight in this sector.

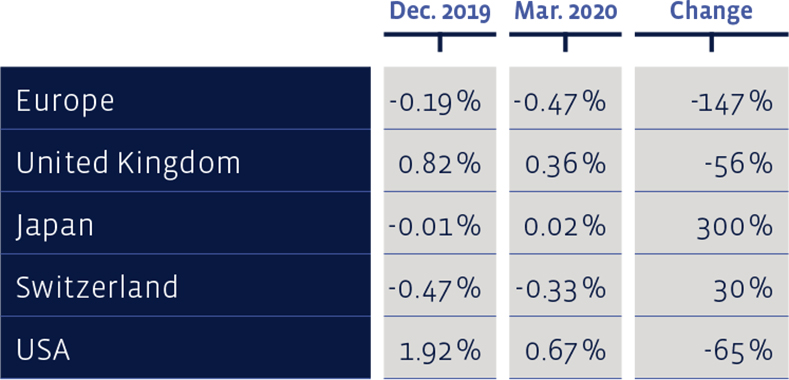

During the course of the year, yields on 10-year government bonds declined almost everywhere:

Equities Switzerland

In the main, due to the index heavyweights Nestlé, Novartis and Roche, Swiss equities exited the past quarter less dishevelled than their counterparts in other countries. The trio accounts for about 50% of the index. In general, large capitalised stocks fared better than medium or small capitalised stocks. The directly invested “Swiss-Stock-Portfolio” (SSP) suffered a loss of 16.4% during the first quarter. The Swiss Performance Index (SPI) lost 11.8% over the same period. We are slightly underweight Swiss equities now.

In the long term, the performance of our value-criteria driven selection is quite respectable. Since 2012, the average annual performance of the SSP amounts to 12.7%, a result that beats the average benchmark’s performance of 9.5% markedly. Since 2012, the total cumulative return of this strategy amounts to about 168%, while that of the index to 112%. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs. The “Strategy Certificate linked to the SIM Swiss Stock Portfolio Basket” (Valor: 36524524, ISIN: CH0365245247) declined by 16.7% during the first quarter.

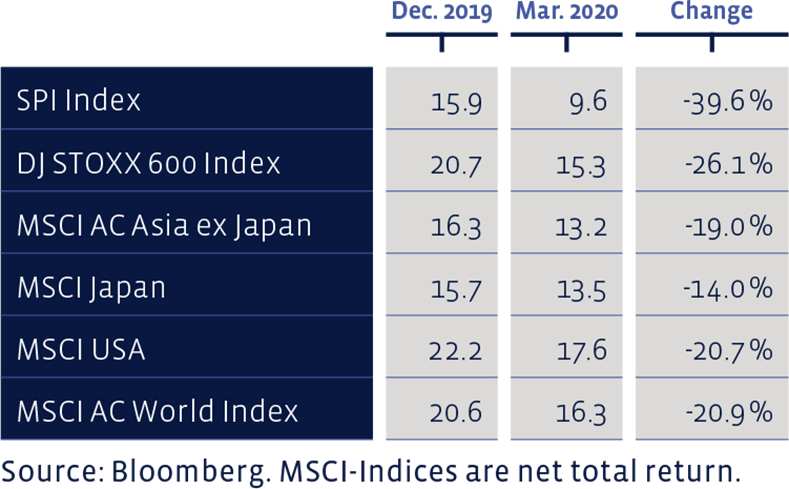

Measured on the price/earnings ratio using the latest 12 months profit figures, all equity markets have become more attractive since the beginning of the year:

The regular annual rebalancing is upcoming during the second quarter, whereby the fundamentally most attractive stocks of the Swiss equity marked will be added to, respectively, remain in the portfolio, whereas the most expensive stocks will be sold. During these times, even more than usual the focus will be on high quality. At the same time, the weighting of the individual components will be adjusted. Direct investment will be affected equally as is the composition of the certificate.

Equities Europe

Our value-style centric, directly invested “European Stock Portfolio” (ESP) suffered a loss of 28.7% during the first quarter, measured in Euro. The broad Dow Jones Stoxx 600 Index suffered a loss (price change plus dividends) of 22.6%% during the same period, whereas the value-style driven Dow Jones Stoxx 600 Value Index lost 29.2%.

In the long term, the ESP displays a marked outperformance against the broad index. Since 1993, the ESP has returned on average 7.2% compared to the 6.1% achieved by the benchmark. The transaction costs, as well as taxes withheld, are deducted in ESP figures, whereas the index is calculated without bearing any costs. The cumulative performance of the ESP since 1993 amounts to about 608%, while that of the benchmark to about 429%.

The rebalancing described in the preceding “Equities Switzerland” paragraph will similarly be executed for European stocks during the coming weeks. We are currently underweight European equites.

Equities USA

American equities have gone to rack and ruin, whereas the Performa US Equities Fund employed by us did better than the benchmark. The same applies to the BB Adamant Medtech & Services Fund engaged in the specialist sector of medicinal technology. We have not made any changes to the US stock weighting and with that continue to be overweight.

Price/Book and Dividend Yield of major equity markets:

Equities Asia (excluding Japan)

Equities in emerging economies were also dragged down, although to a lesser extent than in Europe. Having said that, neither was this part of the world amongst the top performers in 2019. We left the allocation unchanged during the quarter and with that, underweight.

Equities Japan

The verdict on equities in the Land Of The Rising Sun was similar to the above. The positioning remained unchanged and slightly above neutral weight.

Alternative Investments

Alternative investments suffered less than equities. Here we divested the larger part in March to create sufficient liquidity for potential equity purchases. With that, we are newly underweight here.

Precious Metals

A rise of 10% to nearly 1700 US Dollars per ounce by mid-March was followed by a precipitous fall to below 1500. For gold, which has the reputation of serving as a safe haven, to suffer a reversal like this, makes us think that during the worst days market participants were forced to dump the precious metal onto the market to stop up gaping holes elsewhere. Since then, the price has recovered to about 1600 US Dollars. We kept the position unchanged, which corresponds to an overweight position.