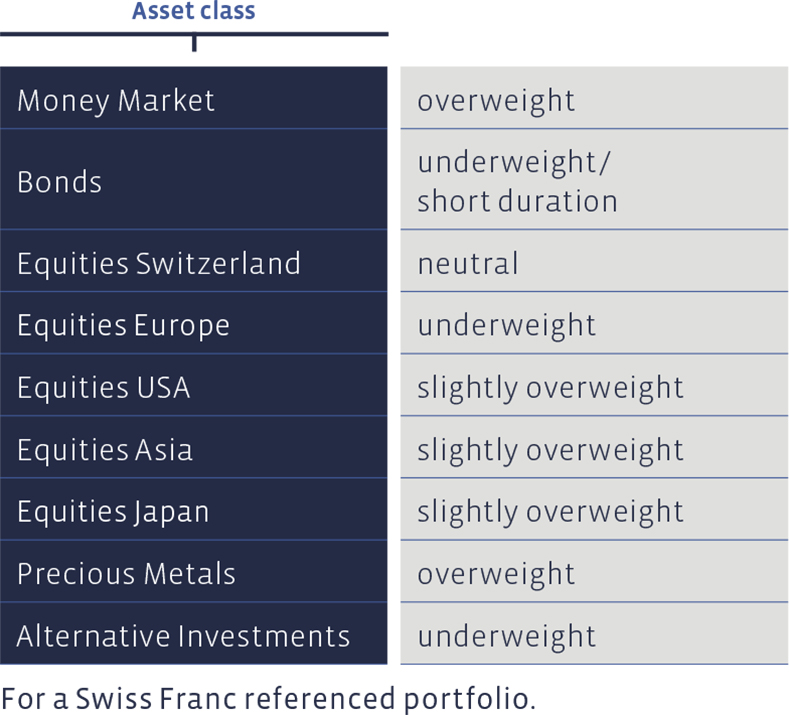

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium risk balanced Swiss Franc portfolios, not subject to client’s restrictions. Mandates in different reference currencies at times display different nominal weightings and weighting changes.

Money Market

The money market quota fell somewhat in the final quarter because we made an additional bond purchase in a proven investment fund. It still stands: Money market investments are not simply money for which we have no investment ideas, but a strategically and tactical instrument that is used in a targeted manner, which serves as a buffer against price fluctuations in other asset classes and as a reserve so that we can quickly seize opportunities.

Bonds

In mid-November, within the bond portfolio we increased the holding in the globally operating Acatis IFK Value Renten Fonds, which has proven itself over the years. This was executed immediately after having been able to talk to the fund manager about the latest status of his work and the fund’s annual distribution. Despite this adjustment, we are still underweighted in bonds overall and are at the lower end of the range of the strategic asset allocation.

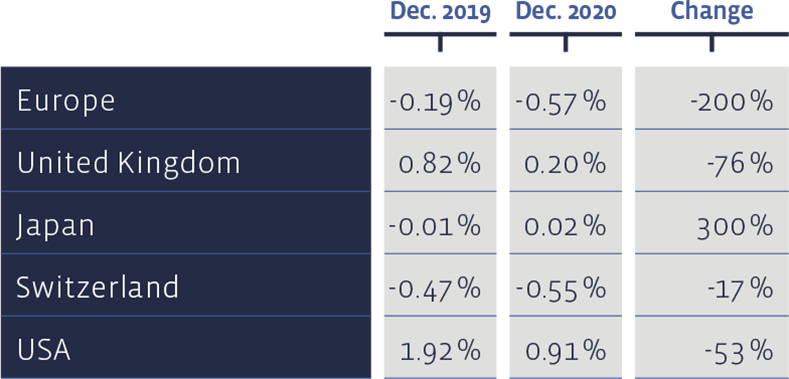

During the course of the year, yields on 10-year government bonds declined almost everywhere:

Equities Switzerland

The Swiss stock market continued to improve in the fourth quarter (Swiss Performance Index, SPI +4.7%), which means that our home market also posted a positive performance for the whole year (+3,8%). Our direct investment portfolio “Swiss Stock Portfolio” (SSP) ended the year with a plus of 2.9% and was able to narrow the gap to the index.

The outperformance of our selection of stocks compared to the overall market since May can be seen as a direct consequence of the increased focus on qualitative factors in the spring.

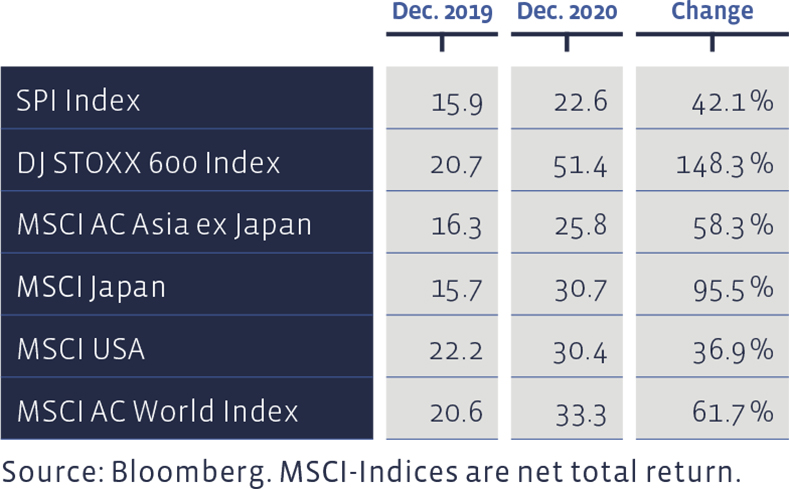

Measured on the Price/Earnings ratio using the latest 12 months profit figures, all equity markets have become more expensive since the beginning of the year:

Over the course of the year, Also (+58% over a year), LafargeHolcim (+33% since purchase in May) and Siegfried (+40% over a year) were among the best securities in this stock selection, which was compiled according to value criteria. The heavyweights in the index such as Nestlé, Novartis and Roche, on the other hand, failed to shine for once in 2020 and lagged the overall market development during the recovery. For the “Strategy Certificate linked to the SIM – Swiss Stock Portfolio Basket” certificate (Valoren no: 36524524, ISIN: CH0365245247) based on the SSP, the performance for 2020 is 1%.

In the long term, the development of the “Swiss Stock Portfolio” is quite presentable. Since 2012, the average annual performance of the SSP amounts to 14.2%, a result that beats the average benchmark’s performance of 10.7% markedly. Since 2012, the total cumulative return of this strategy amounts to about 230%, while that of the index is 149%. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

Equities Europe

Our European direct investment portfolio, the “European Stock Portfolio” (ESP), had a picture-perfect quarter. Its value shot up by no less than 18.1% in the last three months. After the good news from vaccine manufacturers and the adoption of gigantic aid packages around the world raised hopes for an early end to the pandemic and its economic consequences, the markets saw massive shifts to previously badly shaken value stocks.

The ESP was ahead of the broader market, represented by the Dow Jones Stoxx 600 Index, by over 7 percentage points in this period. Since the changeover in April, when the focus on balance sheet and dividend quality was also sharpened - analogous to the Swiss stock selection - the ESP has outperformed the market by over 18 percentage points.

The stocks of Neste (refinery, Finland) with a plus of 108%, ASM International (semiconductor, Netherlands) with +91% and Siltronic (silicon wafers, Germany), which were quoted 84% higher on New Year's Eve than in April, were among the best performance suppliers of this European stock selection since the reorganization in April.

The latter company has since agreed to a takeover offer from Taiwanese competitor GlobalWafers Co, and we have sold the stock. Overall, this share has delivered a total return of around 66% since its purchase in April 2019, significantly more than the overall market, whose performance for the period in question amounts to 8.1%.

For 2020, the overall performance (price changes plus distributions) of the European Stock Portfolio adds up to 3.69%, while overall market was down 1.99%. The Dow Jones Stoxx 600 Value Index, which is focused on the value style, shows a minus of 9.59% for the whole year.

In the long term, the ESP displays a marked outperformance against the broad index. Since 1993 the ESP has returned on average 8.4%, compared to 6.8% achieved by the benchmark. The transaction costs, as well as taxes withheld, are deducted in ESP figures, whereas the index is calculated without bearing any costs. The cumulative performance of the ESP since 1993 amounts to about 930%, while that of the benchmark to about 569%.

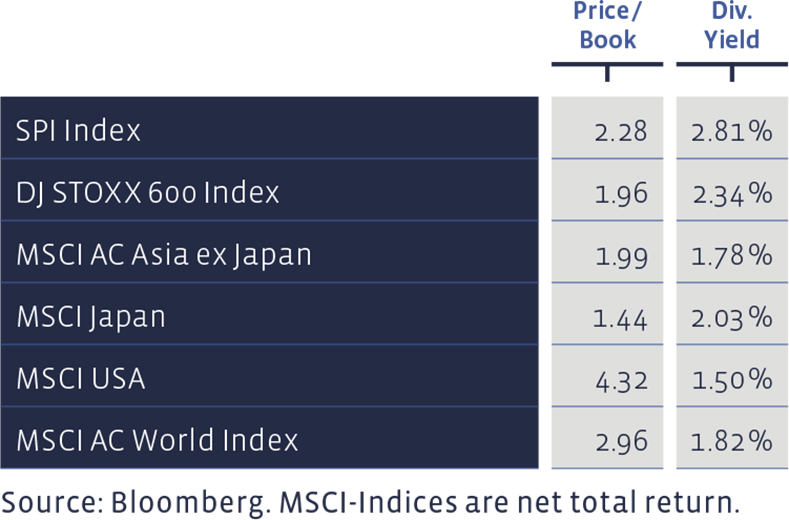

Price / Book and Dividend Yield of major equity markets:

Equities USA

The records tumbled in series on Wall Street. Thus, over Christmas, the most important indices such as the well-known Dow Jones Industrial Index, the broader S&P 500 index and the Nasdaq index recorded new highs. The highest-rated company in the world in terms of market capitalization – Apple –, the most expensive software giant – Microsoft –, the most heavily capitalised retailer – Amazon – as well as the most expensive car manufacturer in the world – Tesla –; they all are listed on Wall Street and caused share prices to soar to heights previously hard to imagine.

The Performa US Equities Fund we used benefited in a most gratifying manner from this tailwind. Yes, it was even much faster on the way than the high-flyer Nasdaq and ended the year with a full plus of 52.6%. The BB Adamant Medtech and Services Fund and the MSCI World Energy ETF have also moved up, the latter mainly thanks to the impressive rally in the fourth quarter.

Equities Asia (ex Japan)

With even more momentum, the equity markets of the Asian emerging markets were catapulted through the fourth quarter. The MSCI Index Asia ex Japan gained over 18% in the last three-month period, bringing the annual result to a plus of 25%.

The fund employed by us, the Aberdeen Asia Pacific Equity Fund, gained around a quarter in the final quarter alone and can therefore look back on an annual result of around 29%. The Barings ASEAN Frontiers Equity Fund also got off to a tailor-made start, climbing almost a fifth since its purchase at the end of September. As a result of the price gains, we are now somewhat overweight in the Asian emerging markets.

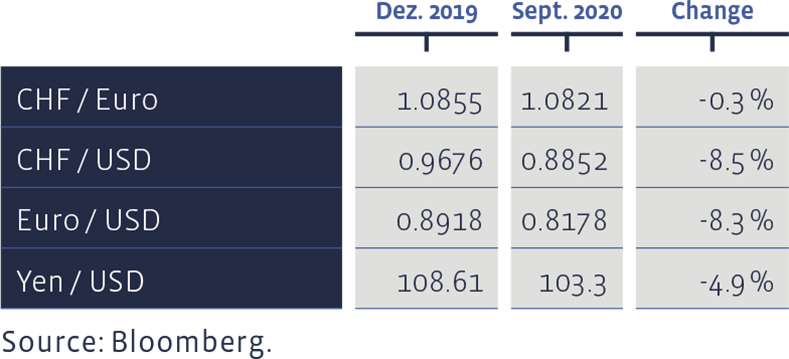

Since the beginning of the year selected foreign exchange rates have developed as follows:

Equities Japan

The fact that the sun rises in Japan was also true in the final quarter of Kabutocho, the Far Eastern counterpart to Wall Street and City of London. It was a bit more leisurely here than in the emerging markets or in the USA, but given the three-month performance of the leading index of almost 13% and an annual performance of around 9%, investors and stock market traders were allowed to treat themselves to some sake and sushi at Christmas. The GAM Japan Equity Fund employed by us even provided a little more purchasing power for culinary delights. We have not changed anything in this position and are therefore still slightly overweight in Japan.

Alternative Investments

For the alternative investments, too, the final result for 2020 lights up in lush green. Although this investment category did not necessarily tear the thickest ropes, it had been punished much less in March than other investment classes. We made no changes to the positions in the fourth quarter and are therefore still underweight.

Precious Metals

As a major exception in the overview of the various investment categories, gold went on the spot in the last quarter of the year. That is not a problem, however, as the annual result shines with a plus of around 24%. In view of the low real interest rates, the rather weak dollar and the unchanged dominant uncertainties regarding global political and economic developments, we have so far seen no reason to part with the precious metal. Perhaps the consolidation of the fourth quarter can be described with the stock market saying “reculer pour mieux sauter”, i.e., “go back to jump higher”. We kept the positions unchanged, which represents an overweight position.

Summary of our current Asset Allocation: