At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

Money market

We have been using some of the liquidity gradually for selective purchases of bonds. Apart from that, it can be said that there is finally some return in this investment category again, as long as investments can be made in call and fixed deposits. Depending on the bank, however, certain minimum amounts have to be complied with. When it comes to interest on account balances, on the other hand, the banks are still very cautious, if not to say tight-fisted.

Bonds

Moving sideways, that sums up the performance on the bond markets in the third quarter in a nutshell. It is noteworthy how currency hedges have become more expensive due to the differences in interest rates between the various currencies that once again exist.

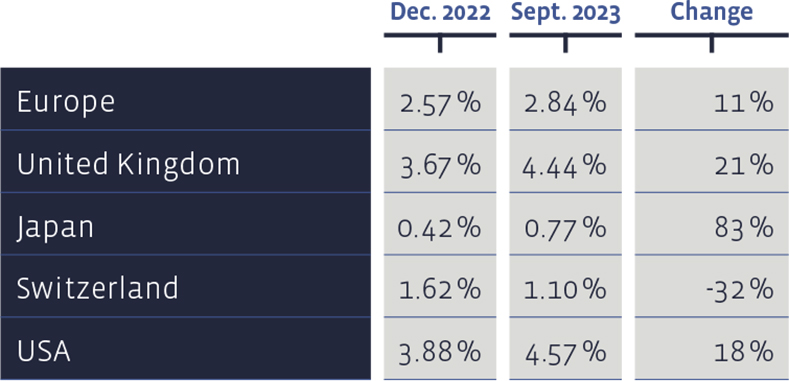

Since the beginning of the year, yields on ten-year government bonds have risen almost everywhere:

While in times of global zero or negative interest rates there were hardly any differences in performance between individual currency classes of the same fund, it is now apparent that hedging costs are again leading to significant differences in performance. This is due to the fact that interest rate differences between the various currencies have widened again.

For example, the Acatis IfK Value Renten fund, which has performed well, has returned 5.7% in terms of Euros over the year to date. The same fund in the Swiss Franc tranche hedged against the currency risks has achieved only 4.3%. Naturally, this development can also be observed with hedged equity funds (see also tables "The equity funds employed by us..." and "Other funds employed by us...").

Equities Switzerland

The market “Blues" did not pass Swiss equities by. The Swiss Performance Index (SPI) fell 3.3% in the third quarter.

Nevertheless, our stock selection based on value criteria, the "Swiss Stock Portfolio" (SSP), has generated a pleasing result so far this year with an overall performance (price changes plus dividends) of 7%. The Swiss Performance Index (SPI), which serves as a benchmark, was up 4.6% by the end of September.

The stocks of UBS (+25.4%), Also (+19.6%) and Swiss Life (+9.3%) performed particularly well in the SSP. UBS made rapid progress following its takeover of CS, creating clarity and confidence in the investment community. Swiss Life benefited from the Group's good business performance, which, as with many other insurers, is being boosted by the higher interest rate level.

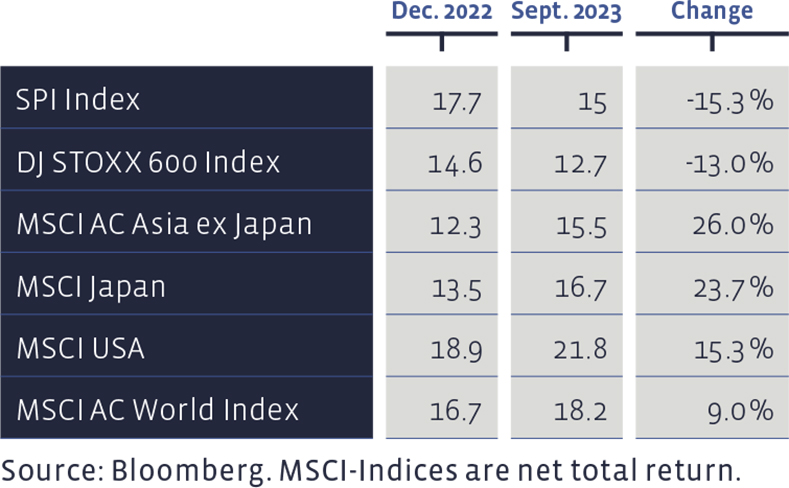

The price/earnings ratios based the latest 12 months profit figures, have varied in numbers:

For the third quarter, Zehnder (-25.7%), Lonza (-20.2%) and Barry Callebaut (-15.6%) brought up the rear. While the former company is feeling the effects of the slump in the European construction industry, Lonza securities suffered as a result of the departure of its CEO, Pierre-Alain Ruffieux, and the discontinuation of the Moderna Corona vaccine production at the Visp site.

The performance of the SSP is very good over the long term. Since 2012, the average annual performance has been 11.3%, clearly outperforming the median benchmark performance of 8.8%. Since 2012, this strategy has achieved a cumulative total performance of around 250%, the index one of 169%. Transaction costs are deducted in the SSP figures, whereas the benchmark index is calculated without costs. The positions were not actively changed, which means that we are currently neutrally weighted.

Equities Europe

The performance of European equities was very similar. The overall market, as measured by the DJ Stoxx 600 Index, was down 2.1% over the three-month period. Nevertheless, our direct investment selection, the "Europe Stock Portfolio" (ESP), managed to make up further ground. Over the past three months, it has risen by 1.3%.

Over the course of this year, this value-oriented selection has delivered an overall performance (price gains plus dividends) of 9.9% whereas the benchmark index DJ Stoxx 600 has achieved 8.5%.

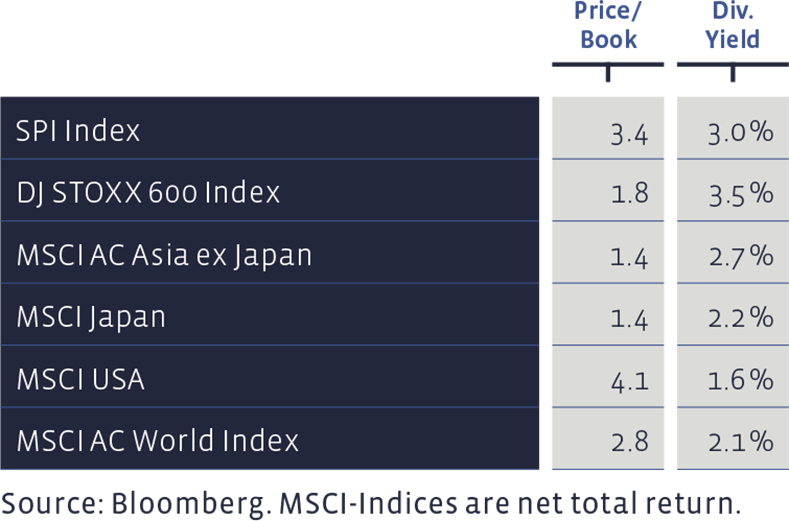

Price / Book and Dividend Yield of major equity markets:

The best-performing stocks of the quarter in the ESP were the Norwegian Equinor and the Spanish Repsol, each with a performance of around 20%. Rising oil prices helped these two energy stocks. The Norwegian fish and seafood producer Mowi (+16.6%) followed in bronze medal position. Not in favour were the shares of Volkswagen (-11.4%), Tietoevry (IT services, -12.8%) and DHL Group (-13.8%).

The long-term performance of the ESP since 2004 shows an annual average return of 7%, compared to 6.4% for the benchmark. The portfolio has thus accumulated a total of 278% since 2004, compared with a cumulative index performance of 238%. Moreover, transaction costs and withholding taxes have been deducted from the ESP figures, whereas the benchmark index is calculated without costs. We are slightly underweight in European dividend stocks. The performance of the SSP and ESP can always be tracked on our website www.salmann.com in the "Investment Strategies" section.

Equities USA

The American stock market also lost steam in the third quarter. The broad market barometers such as the MSCI or the S&P 500 index each lost about 3%. So far this year, however, Wall Street remains among the best-performing markets in the world and has defended its double-digit performance for the nine-month period. The technology index, Nasdaq, continues to race ahead. It has gained 25% since New Year's Eve, not least because of the hype surrounding Artificial Intelligence.

The performance of the American stock market, however, has to be qualified with a big “But". The good performance of the indices is essentially due to eight stocks, namely Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Meta and Berkshire Hathaway (which in turn holds a large position in Apple). These stocks account for 29% of the S&P 500 index. If all 500 stocks in the index were equally weighted, the market would only show a black zero so far this year, writes the independent research institution, "The Macro Strategy Partnership".

We have made no changes in US equities over the past twelve-week period and remain slightly overweight.

Equities Asia (without Japan)

Asian equities were also hit early in the summer by an autumnal melancholy and began to fade. A commendable exception was India, where the price advance of the first quarter continued. The positions did not change, nor did the neutral weighting.

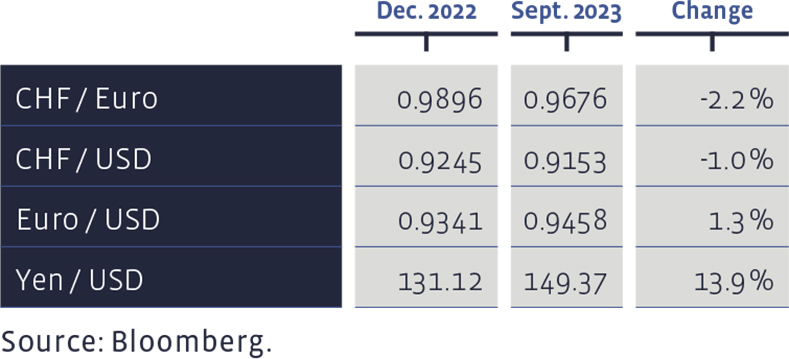

Since the beginning of the year, our selected currency rates have performed as follows:

Equities Japan

In Japan, the market presented its cheerful side, which helped the Land of the Rising Sun to defend its double-digit performance for the year. We made no changes in the third quarter and are now overweight here as a result of the relative value shifts against other markets.

Alternative Investments

We have not made any changes to the holdings and are therefore remain underweighted.

Precious Metals

We currently do not hold any precious metal positions

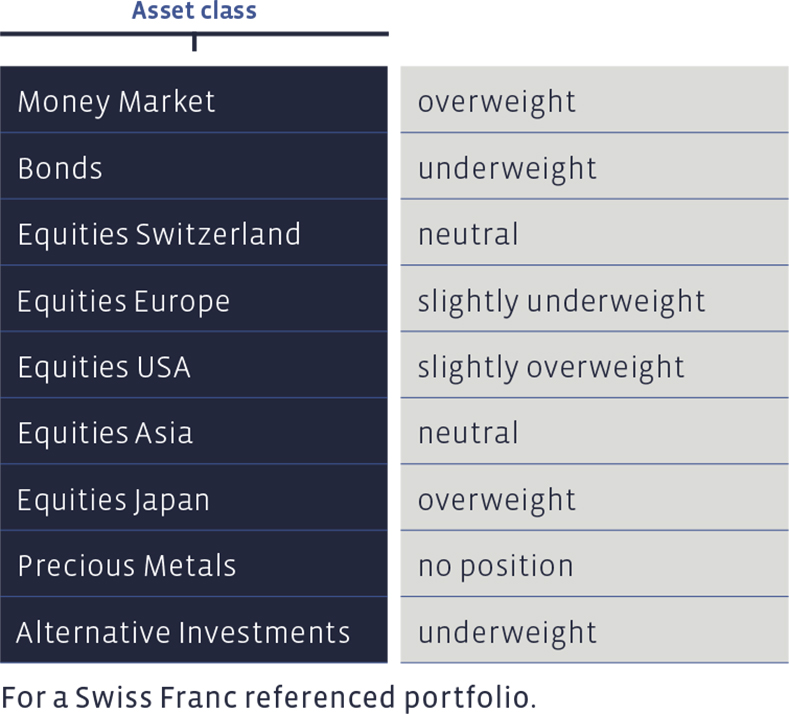

Summary of our current Asset Allocation: