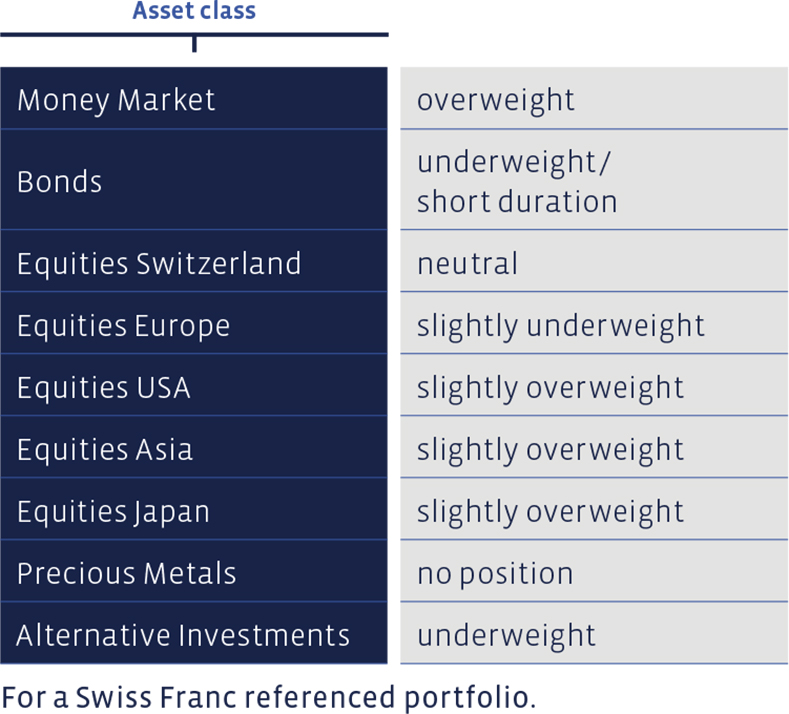

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

Money market

Due to the sale of the remaining gold position in July, the money market ratio increased again in the third quarter. Overall, we are now overweight in liquid assets.

Bonds

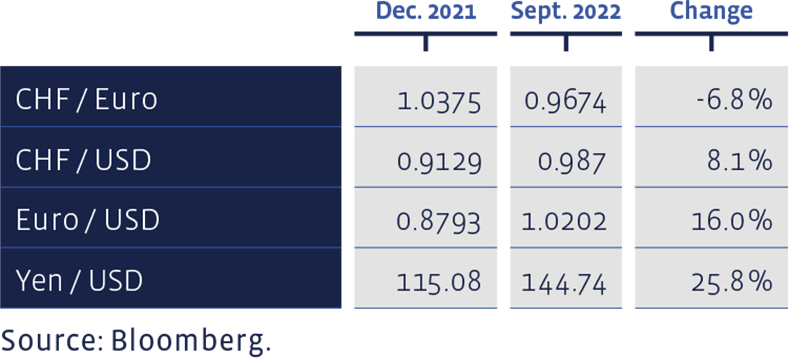

Finally, bonds that offer a positive interest rate worth mentioning can be found once again. This is good news for investors who want to make new investments or who are looking for successor investments for maturing securities. In US dollars, attractive buying opportunities could soon arise for slightly longer-term securities, whereas in Swiss Francs and Euros, the focus should still be on short durations, and thus maturities of no more than five years. We did not actively change our positions during the reporting period and continue to be underweighted in bonds

Equities Switzerland

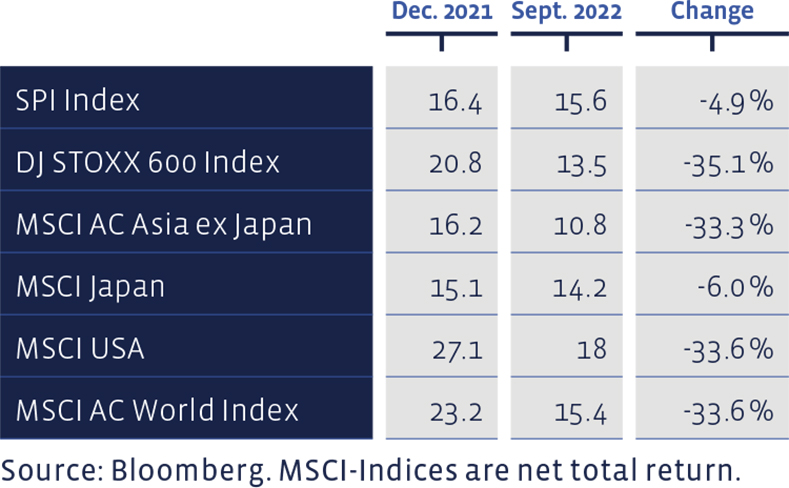

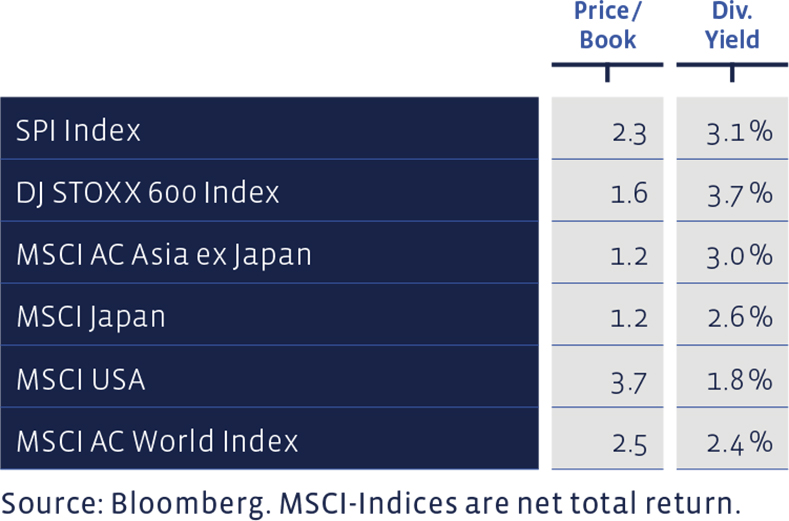

Our value stock selection, the «Swiss Stock Portfolio» (SSP), had to concede some terrain compared to the benchmark SPI. This is also due to the fact that the index benefited from the relatively solid performance of its dominant heavyweights Nestlé, Novartis, Roche and Zurich Insurance.

The price/earnings ratios based the latest 12 months profit figures, have become cheaper everywhere:

The SSP, which also includes numerous medium-sized and smaller companies (mid and small caps) with the same weighting as the aforementioned Blue Chips, was more severely affected by the greater price erosion in the mid and small cap sector. Only Holcim, Siegfried and Tecan were able to end the quarter with price advances. The red lanterns went to Also, Sonova and Vetropack, where the interim results were below analysts' expectations or, in the case of Vetropack, the destruction of a plant in Ukraine had a direct impact on the company.

Over the course of the year to date, the performance of the SSP is -23.5%. From a long-term perspective, the performance is more positive. Since 2012, the average annual performance amounts to 10.9%, clearly outperforming the average benchmark performance of 8.75%. Since 2012, this strategy has achieved a cumulative total performance of around 204%, compared to 146% for the Index. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

Equities Europe

The European stock selection, the «European Stock Portfolio» (ESP), was also unable to evade the poor stock market performance. It lost 4.7% in the quarter, which is 23% since the beginning of the year. The DJ Stoxx 600 Index is down 18.6% for the first nine months. Hannover Re, SSAB and IG Group were among the best performers last quarter, while UK property stocks Persimmon and Barratt Developments (interest rate rise, recession fears) were among the worst. Transaction costs and withholding taxes are deducted from the ESP figures, whereas the benchmark index is calculated without costs.

The long-term performance of ESP since 1992 continues to speak in favour of the value style applied in this selection. Over this period, ESP has achieved an average annual performance of 7.2%, compared with 5.9% for the benchmark. The portfolio has thus accumulated 837%, whereas the cumulative index performance is 585%.

Price / Book and Dividend Yield of major equity markets:

Equities USA

The positions are unchanged. Due to the high weighting of growth stocks, which react particularly sensitively to interest rate hikes, the Nasdaq Index in particular took a beating in the USA. But the broader market as a whole was also unable to evade the downward spiral.

Equities Asia (ex Japan)

The positions in Asian equities and thus the slight overweighting also remained unchanged.

Equities Japan

Japan seems further away than ever. Although share prices also fell, they did not fall nearly as much as on other stock exchanges. In the third quarter, the most important stock indices even trended more or less sideways. In terms of inflation and interest rate hikes - both of which are hardly an issue in the Land of the Rising Sun - the Island Kingdom is also like a different planet. The weak yen, however, is not a cause for celebration, but thanks to the currency hedges it did not affect our (unchanged) positions

Since the beginning of the year, the selected foreign exchange rates have performed as follows:

Alternative Investments

Hedge funds offer counter-cyclical (relative) hedges against equity market risk in general, as well as against specific risks from, for example, political crises. This year, they have again achieved a relative out-performance compared to the global equity and bond markets. The asset class remained unchanged in the third quarter.

Precious Metals

Gold (and silver) seem to be losing their role as a hedge against inflation temporarily. This has to do with rising interest rates and the resulting increase in opportunity costs for precious metals. After we had already halved the gold positions in the second quarter, we also sold the rest at the beginning of July.

Summary of our current Asset Allocation: