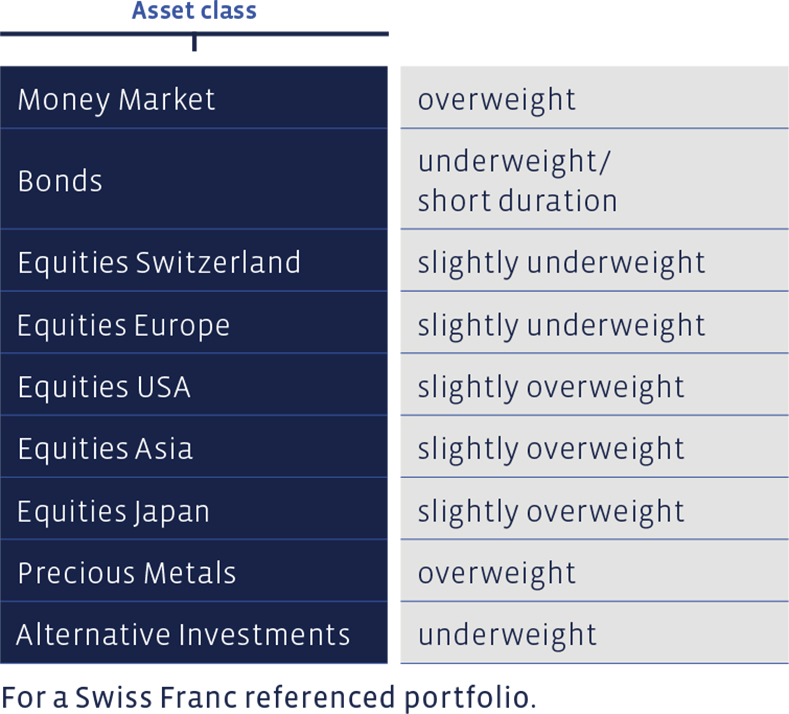

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions. Mandates in different reference currencies at times display varying nominal weightings and weighting changes.

Money market

The money market allocation has increased because we sold a portion of the gold position. Overall, we are currently overweight in liquid assets.

Bonds

We sold the SwissRock Absolute Return Bond Fund and bought units in the Plenum European Insurance Bond Fund. This highly specialised fund invests in lower tier bonds issued by European insurance companies. The focus is on so-called Tier 1, Tier 2 and Tier 3 bonds. Since the capital structures and financing of companies in the insurance industry require a great deal of specialised knowledge that is not widely available on the broader market, investors often neglect this area of the bond market. It is for this reason that higher returns are possible than is the case with ordinary bonds. Apart from banks, life insurers are the only industry that benefits from rising interest rates. European insurers are very robustly capitalised and, as a sector, are less affected than others in the event of a possible recession.

Equities Switzerland

After the annual realignment in Spring, our «Swiss Stock Portfolio» (SSP), which is composed of the most attractive Swiss value equities, presents itself in fresh green. The equities of Bucher Industries, UBS and Lonza have been newly added. The equities of Holcim, SFS Group, Vetropack and Zehnder remain unchanged in the Basic Materials/Industrials sector as do Bell Food, Emmi, Forbo, Nestlé, Lonza and Swatch in the Consumer Goods sector.

In the technology sector, Also and Swisscom retain their positions. The financial sector continues to be represented by Cembra Money Bank, Helvetia and Swiss Life. The previous representatives of the chemical and pharmaceutical sectors, Alcon, Coltene, Novartis, Roche, Siegfried, Sonova and Tecan have also succeeded in remaining in the selection. On the other hand, Schweiter Technologies, Swiss Re and, at an earlier date, Vifor Pharma have been removed from the portfolio.

Over the course of the year to date, the performance of this selection of equities has been -17.4%. This was slightly below the Swiss Performance Index (SPI) of -15.9%. Over the long term, the performance of the «SSP» continues to be good. Since 2012, the average annual performance amounts to 12%, which clearly exceeds the average benchmark performance of 9.5%. Since 2012, this strategy has achieved a cumulative total performance of around 228%, while the index has achieved 159%. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

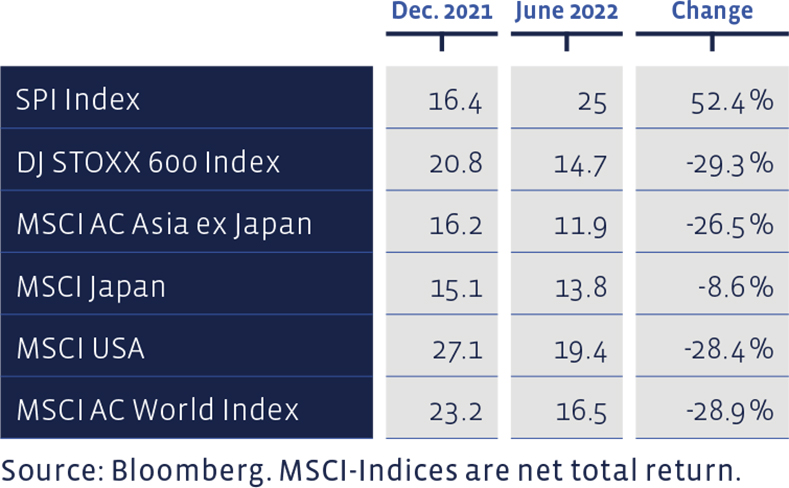

The price/earnings ratios based the latest 12 months profit figures, have become cheaper almost everywhere:

Equities Europe

The European equities selection, the «European Stock Portfolio» (ESP), also has a new composition. The equities of Equinor (energy), Deutsche Post, SSAB (steel) as well as the equities of the electronics manufacturer Spectrics and the logistics company Moller-Maersk are new among the fundamentally most attractive equities. Also new are the equities of the lift and escalator producer, Kone, and those of Mercedes-Benz.

In the technology sector, the newcomers are BE Semiconductor from the Netherlands and Logitech from Switzerland. The new additions from the financial sector are Sofina (investments), Hannover Re (reinsurance), and Nordea Bank. In the chemicals and pharmaceuticals sector, the French company Ipsen has made it into the portfolio.

Rio Tinto, Skanska and Neste (mining and industry respectively), the consumer-related Ahold Delhaize and Kindred Group as well as the utilities equity, A2A, continue to be included in this selection. The equities of the British real estate companies, Barratt Developments, and Persimmon, were also able to maintain their positions. Likewise, IG Group and Legal & General remained unchanged on the list, as did Recordati, Yara and Covestro (pharmaceuticals and chemicals sector).

The DJ Stoxx 600 Index ended the first semester at 15% lower. Our European equities selection lost 19.5%. The ESP figures exclude transaction costs and withholding taxes, whereas the benchmark index is calculated without costs.

The long-term ESP performance since 1992 continues to speak in favour of the value style applied in this selection. Over this period, ESP has achieved an average annual performance of 7.8% compared to 6.6% for the benchmark. The portfolio has thus accumulated 878%, whereas the cumulative index performance is 611%.

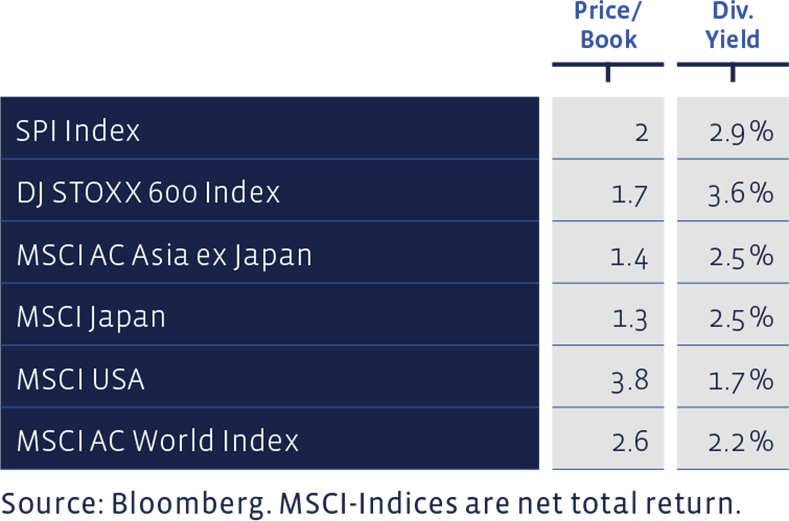

Price / Book and Dividend Yield of major equity markets:

Equities USA

The US equities market has been particularly hard pressed so far this year. While the Performa US-Equity Fund consists of both solid growth companies and promising small companies and therefore suffered even more than the index, the BB Adamant Medtech & Services Fund, which is based in healthcare technology, fared somewhat better. The positions remained unchanged in the second quarter.

Equities Asia (ex Japan)

The positions in Asian equities (excluding Japan) also remained unchanged. There has been no change in the slight overweighting of Asian equities.

Equities Japan

We have also left the positions in the Land of the Rising Sun unchanged and maintained the slight overweighting.

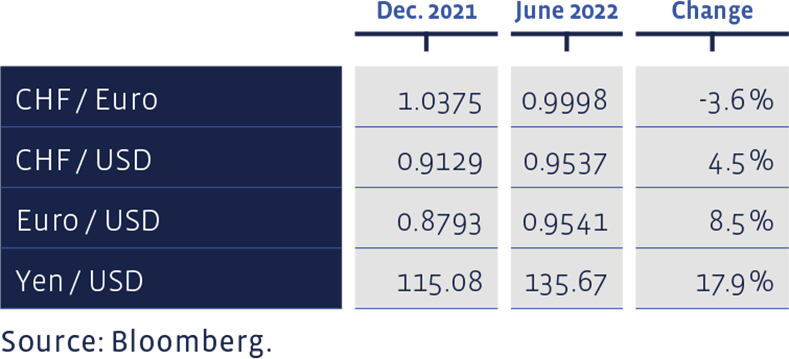

Since the beginning of the year, the selected foreign exchange rates have performed as follows:

Alternative Investments

This asset class also saw no changes in the second quarter.

Precious Metals

The gold price fell away during the course of the quarter. Since gold historically has always had a hard time in times of rising interest rates, and in order to keep liquidity ready for possible equity purchases, we halved the gold positions in the second quarter.

Summary of our current Asset Allocation: