At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

Money market

There was no active change here. Where possible, we also invest in call and fixed-term deposits, which generate at least a small return.

Bonds

We see positive arguments in favour of bonds once again. Initially in US Dollars and recently also in Swiss Francs and Euros, we have slightly increased our holdings as well as the durations (weighted residual terms). The yield curves up to 10 years remain inverted.

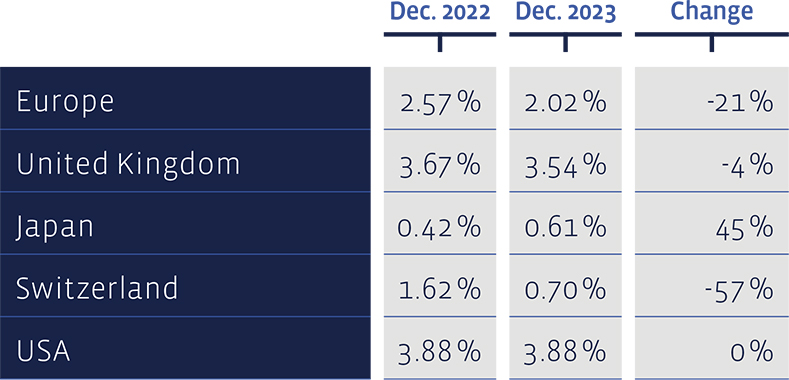

Yields on ten-year government bonds have fallen almost everywhere since the beginning of the year:

Equities Switzerland

The Swiss Performance Index (SPI) rose by 1.4% over the last three months, thereby achieving an annual performance of 6.1%. Our stock selection based on value criteria, the "Swiss Stock Portfolio" (SSP), achieved an overall performance (price changes plus dividends) of 8% for the year and thus generated a pleasing result.

Sonova (+26%), UBS (+15%) and Holcim (+12%) performed particularly well in the SSP in the past quarter. Lonza (-17%), Leonteq and Helvetia Versicherungen brought up the rear, each with a discount of around 10%.

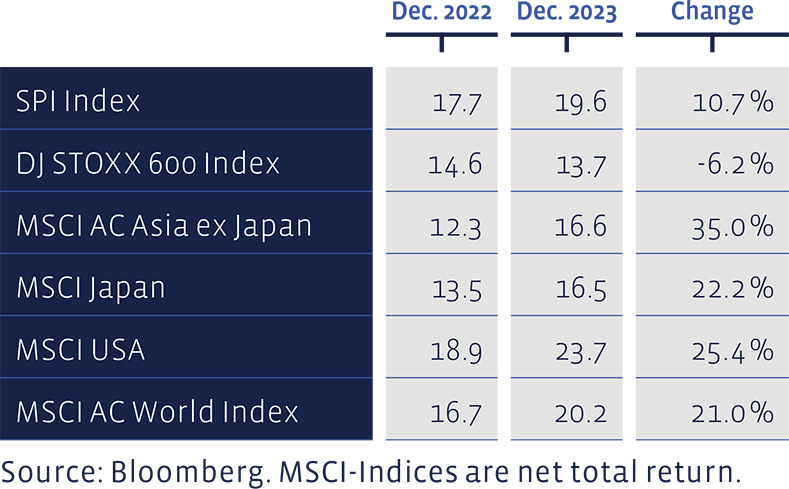

The price/earnings ratios based the latest 12 months profit figures, have developed differently:

The performance of the SSP is very good over the long term. Since 2012, the average annual performance has been 11.1%, significantly outperforming the median benchmark performance of 8.7%. Since 2012, this strategy has achieved a cumulative total performance of around 253%, compared with 173% for the index. Transaction costs are deducted in the SSP figures, whereas the benchmark index is calculated without costs. The positions were not actively changed, which means that we currently have a roughly neutral weighting.

Equities Europe

Despite major challenges, the performance of European equities was positive. In the fourth quarter alone, the DJ Stoxx 600 benchmark index posted an overall performance (price gains plus dividends) of 6.7% in Euro terms. This resulted in an increase of 15.8% for the year. Our direct investment selection, the "Europe Stock Portfolio" (ESP), returned 3.2% in the last three-month period of the year, resulting in an overall performance of 13.5% for 2023.

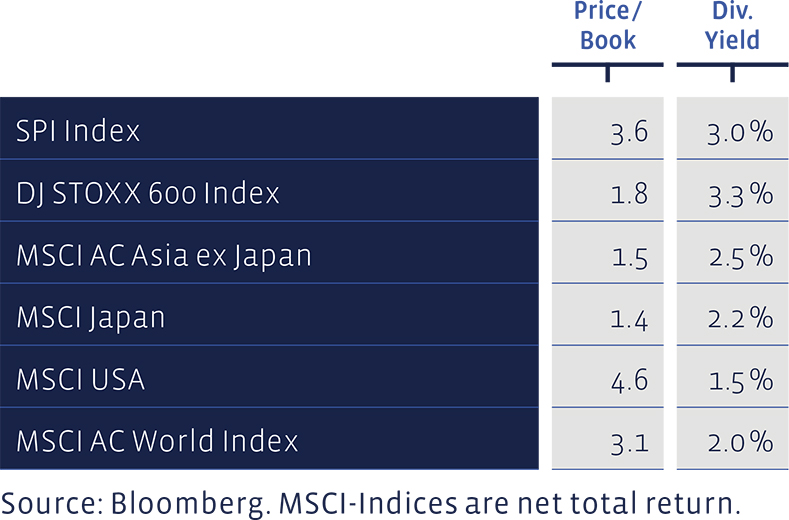

Price / Book and Dividend Yield of major equity markets:

Barratt Developments (+27.5%), IG Group (+19%) and DHL Group (+16.4%) were among the best performers in our selection in the last quarter. The figures are shown in the respective local currencies. The worst performers were Sanofi (-11.5%), Ipsen and Repsol, which fell by around 13% each.

The long-term performance of the ESP since 2004 shows an average annual return of 7.05%, compared with 6.63% for the benchmark. The portfolio has thus accumulated a total of 290% since 2004, compared with 261% for the cumulative index performance. Moreover, transaction costs and withholding taxes have been deducted from the figures for the ESP, whereas the benchmark index is calculated without costs. We are slightly underweighted in European dividend stocks. The performance of the SSP and ESP can also be tracked at any time on our website www.salmann.com in the "Investment strategies" section.

Equities USA

The US stock market had an impressive run. For example, the Nasdaq 100 Index rose by an impressive 54% in US Dollar terms, while the broader S&P 500 Index rose by around 24%. However, it should be noted that this development is primarily a product of the soaring performance of the "Glorious Seven", which are: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Without these Big Caps, which represent around 28% of the index, and have gone through the roof as a result of the hype surrounding artificial intelligence amongst other things, the performance of this market would be more likely to be closer to that of Swiss equities. We made no changes to US equities in the past quarter and remain slightly overweight.

Equities Asia (without Japan)

In the Asian equities segment, we sold the remaining shares in the Aberdeen Asia Pacific Fund and invested the funds released in the Galileo Vietnam Fund. The background to this transaction is our earlier decision to refrain from investing in equities in China for the time being due to political risk considerations. Aberdeen is invested in China with around a quarter of the fund's assets. In addition, Vietnam is in a very dynamic state with equity valuations that remain moderate.

Equities Japan

Another sale relates to the GAM Japan Equity Fund. This fund has recently suffered from capital outflows. As a result, the assets under management have fallen below what we consider to be a sensible level. In the Land of the Rising Sun, we have now invested in the Alma Eikoh Japan Large Cap Equity Fund, in which we have found a good alternative.

Alternative Investments

We have not made any changes to the portfolios and remain underweighted in alternative investments.

Precious Metals

We do not currently hold any precious metal positions.

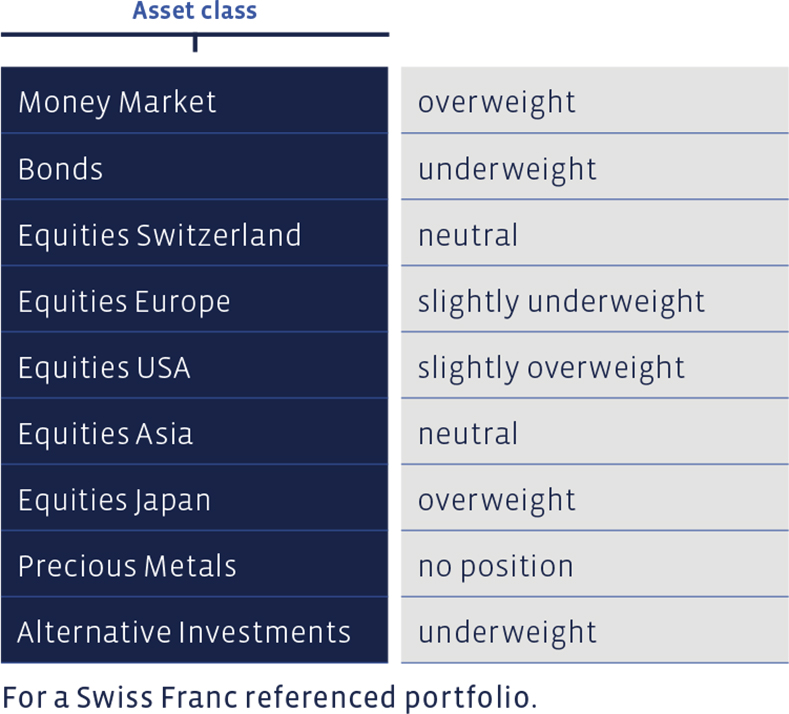

Summary of our current Asset Allocation: