At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions. Mandates in different reference currencies at times display different nominal weightings and weighting changes.

Money Market

The bottom line is that the liquidity ratio has not changed. The funds released from the sale of the energy certificate (see section US stocks) were used to increase alternative investments in the further course of the quarter. We, therefore, remain slightly overweight in cash.

Bonds

There was no change in bonds either. The rise in interest rates has pushed prices down slightly everywhere, but we are still a long way from attractive purchase prices. We are therefore still underweighted in bonds overall and are at the lower end of the range of the strategic asset allocation.

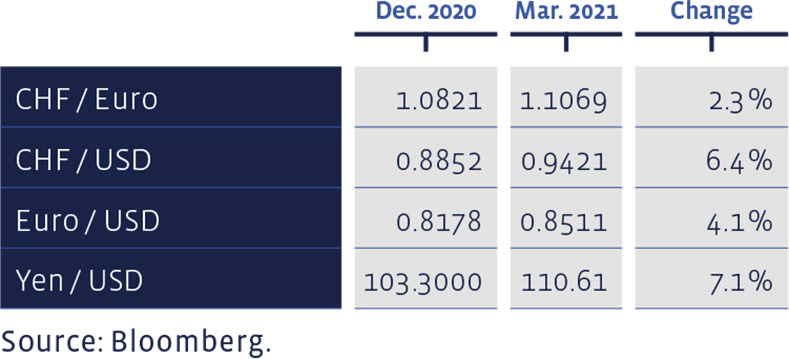

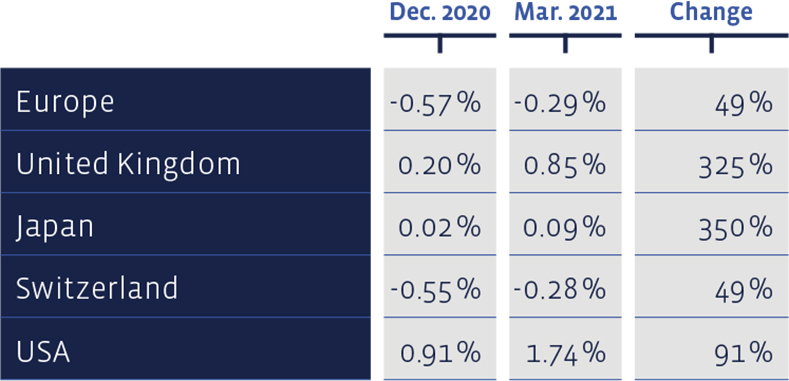

During the course of the year, yields on 10-year government bonds increased almost everywhere:

Equities Switzerland

In the first quarter, Helvetic stocks were able to build seamlessly on the final quarter of the previous year and have risen further. The Swiss Performance Index gained 5.2% (overall performance consisting of price gains and dividends). In particular, the stocks of small capitalised companies (so-called small caps) and the stocks of medium-sized companies (mid-caps) dazzled with increases of + 10.1% and + 8.9% respectively. The heavyweights collectively gained 4.2%.

Our selection of direct investments, the “Swiss Stock Portfolio” (SSP) compiled according to value criteria, gained 8.6% in this period, outperforming the index by more than three percentage points. In this stock selection, too, with Coltene (+ 40%) and Bell (+ 21%) the biggest winners are from the small caps field. Among the medium-sized companies, Siegfried and Helvetia were particularly popular with around 19% performance each. All figures are understood as total income, i.e., price changes plus any dividends.

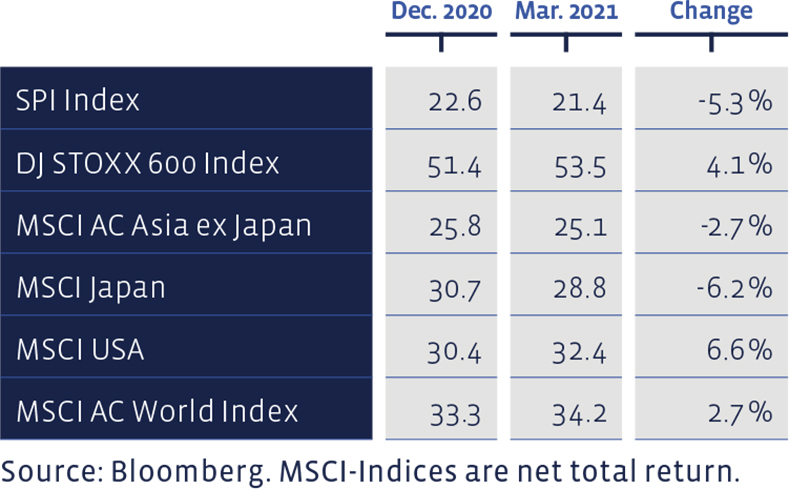

Measured on the Price/Earnings ratio using the latest 12 months profit figures, equity markets have developed differently:

For the “Strategy Certificate linked to the SIM – Swiss Stock Portfolio Basket” certificate based on the SSP (Valor: 36524524, ISIN: CH0365245247), the performance for the first quarter amounts to a plus of 8.3%.

In the long term, the development of the «Swiss Stock Portfolio» is still quite presentable. Since 2012, the average annual performance of the SSP amounts to 14.8%, a result that beats the average benchmark’s performance of 11% markedly. Since 2012, the total cumulative return of this strategy amounts to about 258%, while that of the index is 162%. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

Equities Europe

European stocks also got off to a fulminant start to the year. The Dow Jones Stoxx 600 Index achieved a total return (price changes plus distributions) of 8.2%. Our European direct investment selection, the “European Stock Portfolio” (ESP), even achieved 8.7%. Since the last rebalancing a year ago, the ESP has achieved a total return of 55%, the benchmark, however, produced an increase of around 34% during this period.

In the figures for the ESP, transaction costs and withholding taxes are deducted, whereas the reference index is naturally calculated without bearing any costs. The total cumulative performance of the ESP since 1993 amounts to about 1021%, while that of the benchmark to about 624%.

Among the suppliers of the best performance in this value stock selection in the past three months were the stocks of Dialog Semiconductor, which advanced by over 46% thanks to a takeover offer, as well as ASM International (+ 38%) and A2A (+ 21%). British stocks also did well, especially Tate & Lyle with a positive performance of almost 20%, Barratt Developments with 17% and Persimmon with 16%.

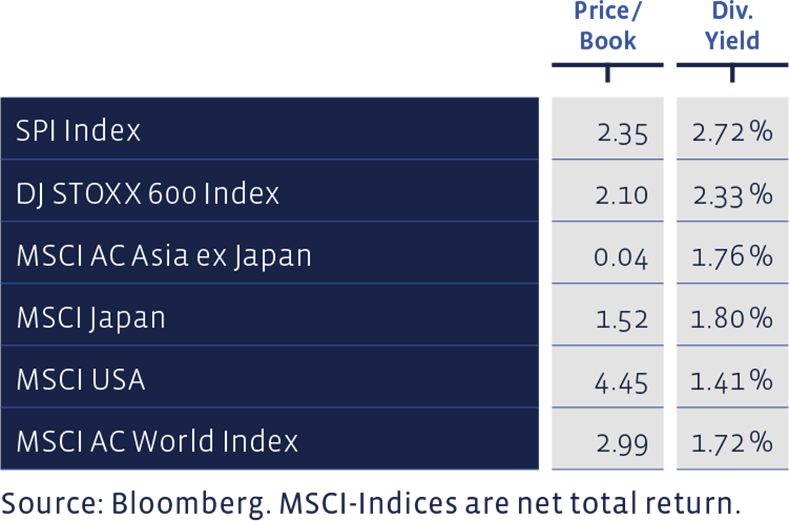

Price / Book and Dividend Yield of major equity markets:

Equities USA

In mid-January, we sold the shares in the MSCI World Energy ETF. The investment, which had a global focus but a good half of which were in US stocks, was acquired as a tactical element last spring after the collapse of the oil price. With the price recovery of the Black Gold, the shares of the energy companies have also risen across the board, triggering the end of this commitment and producing a nice profit. In the portfolios managed in US Dollars, we also reduced the weighting in American equities at the beginning of February. Thanks to the fundamentally higher weighting (home bias) and the price gains, there was a clear overweight here, which has now been corrected.

Equities Asia (ex Japan)

In the Asian developing countries, sights had to be lowered a little in the first quarter. After the impressive 2020 (index + 25%), this region of the world has now achieved an increase of just below 3%. We have not changed any of the positions and are therefore still slightly overweight.

Equities Japan

Secretly and silently, Japanese stocks crept their way up to the top of the international stock exchanges in the first quarter. The broad MSCI Japan Index is up over 8%. As in other markets, cyclical stocks were among the most popular, including mining, steel and air transport. Despite the higher price level, Japanese equities, in an international comparison, are still among the fundamentally rather cheap stocks. We have not changed anything in this position and are therefore still slightly overweight in the Land of the Rising Sun.

Alternative Investments

So far this year, alternative investments have not made much headway. Towards the end of the quarter, we added three percentage points to our exposure by buying units of the BCV Liquid Alternative Beta Fund. This instrument of the Banque Cantonale Vaudoise does not invest in hedge funds but replicates the investment strategy of the funds represented in the leading index using liquid instruments such as futures and swaps. We have used this investment fund before and have made a positive experience with it. Speaking of hedge funds, The Franklin K2 Alternative Strategies Fund has no exposure to the Archegos Hedge Fund, which recently made negative headlines on Wall Street.

Precious Metals

After last year's spectacular rally, in which the price of gold in US Dollars rose by 24%, the precious metal has initially consolidated in the first three months of the New Year. The decline in the exchange rate of around 10% was significantly mitigated for Swiss Franc and Euro investors by the higher valuation of the Greenback. Nothing changed in the positions during the reporting period, which means that precious metals continue to be overweighted.

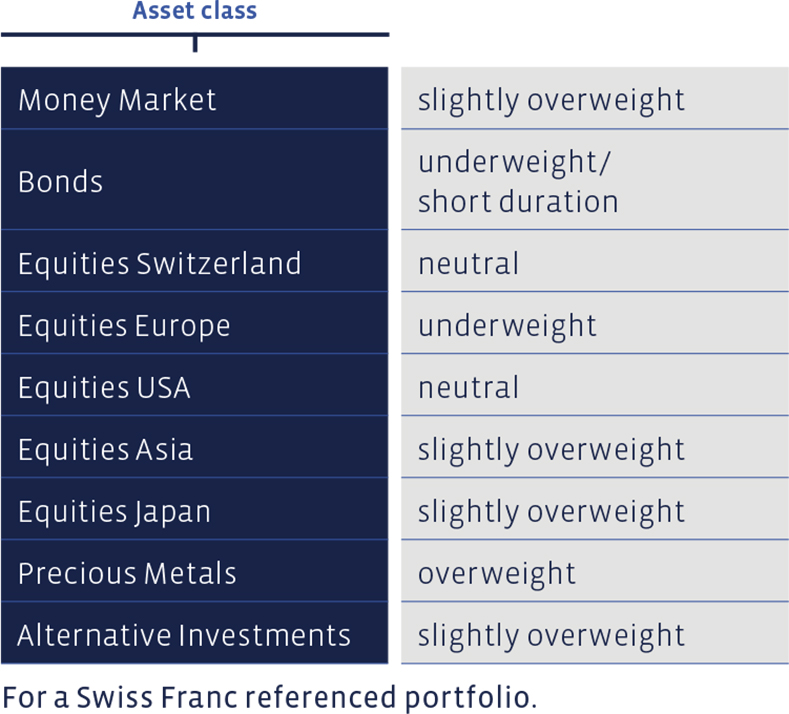

Summary of our current Asset Allocation:

Since the beginning of the year, selected foreign exchange rates have developed as follows: