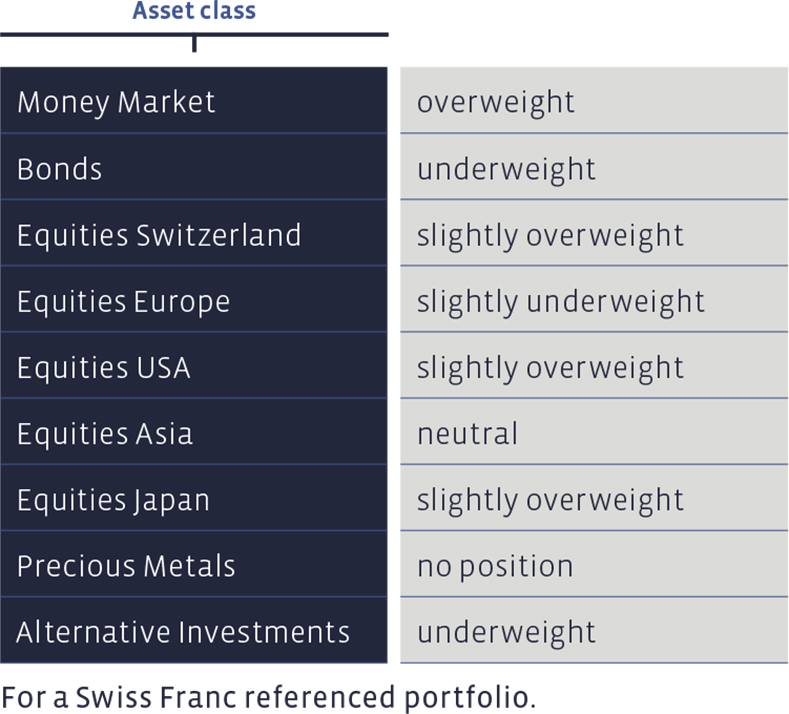

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

Money market

In the second quarter, we started to gradually reduce cash and cash equivalents and to increase the bond ratio (see also section “Bonds”).

Bonds

The market situation for bonds has improved, which is why we have started to further reduce the underweight in this asset class. Specifically, we have increased the tactical bond ratio in Swiss Franc and Euro mandates by up to six percentage points, and in US Dollar mandates by about three percentage points. Coupled with this, we are aiming for a slightly higher duration (weighted residual maturity) of the fixed-interest securities in the portfolios. The adjustment will be achieved by reducing the liquid assets (money market).

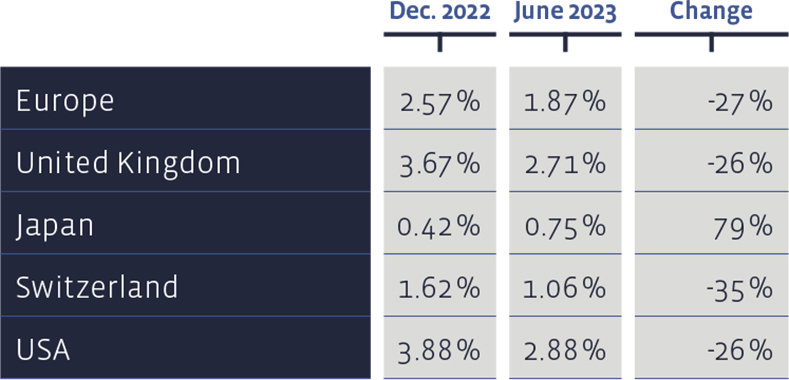

Since the beginning of the year, yields on ten-year government bonds have fallen almost everywhere:

Equities Switzerland

Our value stock selection in Switzerland, the”Swiss Stock Portfolio” (SSP), performed well in the first half of the year. It generated an overall performance (price changes plus dividends) of 10.48% and outperformed its benchmark, the Swiss Performance Index (SPI), by 2.28 percentage points.

In addition, the annual rebalancing took place in Spring. The stocks of Barry Callebaut (chocolate), Leonteq (financial services) and Medacta Group (implants) were the new additions.

The stocks of Bucher Industries, Holcim, SFS Group, Vetropack and Zehnder remain part of the Swiss Stock Portfolio in the Basic Materials/Industrial sector. In the Consumer Goods sector, these are Bell Food, Emmi, Forbo, Nestlé and Swatch. In the Technology sector, Also and Swisscom retain their established positions.

The financial sector continues to be represented by Helvetia, Swiss Life and UBS. The previous representatives of the chemical and pharmaceutical sectors, Alcon, Lonza, Novartis, Roche, Siegfried, Sonova and Tecan, have also managed to remain in the selection of the most attractive Swiss equities. On the other hand, the shares of Cembra Money Bank and, already at an earlier date, those of Coltene were eliminated from the portfolio.

As far as the performance of individual stocks in the quarter is concerned, Alcon, Siegfried and Novartis were the top performers. Bringing up the rear were Leonteq, Tecan and Swatch.

The SSP’s long-term performance is also very good. Since 2012, the average annual performance has been 11.82%, significantly outperforming the median benchmark performance of 9.3%. Furthermore, during the same period, this strategy has achieved a cumulative total performance of approximately 261%, while the index has achieved one of 178%. Transaction costs are deducted in the SSP figures, whereas the benchmark index is cost-free

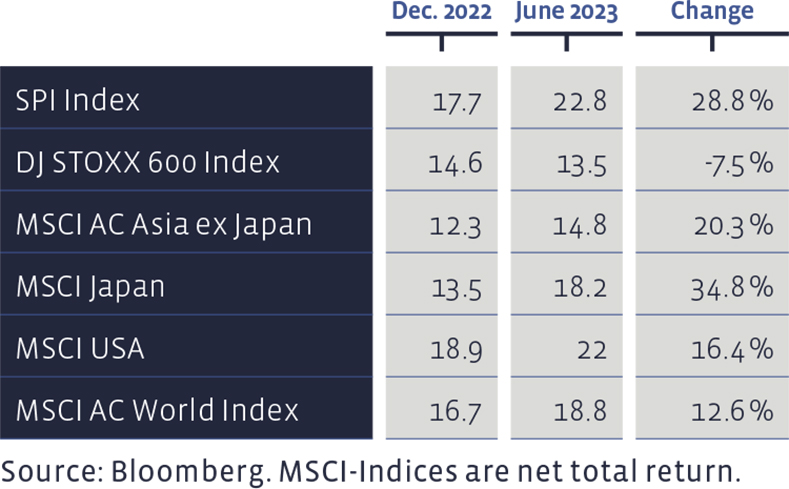

The price/earnings ratios based the latest 12 months profit figures, have mostly increased:

Equities Europe

The European stock selection, the “European Stock Portfolio” (ESP), has also been thoroughly scrutinised and given a fresh makeover. A number of new additions were made. These include Imperial Brands (tobacco products) and Mowi (fish farming) in the consumer sector, Arcelormittal (steel) and Glencore (commodities trading) in the chemicals and commodities sector.

In the energy supply sector, Repsol is a new addition to the selection; in the financial sector it is the MAN Group, and in the health sector Roche and Sanofi. The packaging manufacturer, Mondi, has also made it into the portfolio of the fundamentally most attractive European stocks, as have the technology stocks Capgemini, STMicroelectronics and Tietoevry. Last but not least, Volkswagen is a new addition to this list. On the other hand, 13 stocks were removed from the portfolio.

Ahold, Yara International, A2A, Equinor, Hannover Re, IG Group, Legal & General and Nordea Bank defended their places as did Ipsen, AP Moller-Maersk, Deutsche Post and Barratt Developments.

So far this year, the European stock selection has delivered a total performance (price gains plus dividends) of 8.44%. The benchmark DJ Stoxx 600 Index has managed 10.85%. A2A, Hannover Re and Ipsen were among the best performers in the second quarter, while Arcelormittal, Tietoevry and Mowi brought up the rear.

The long-term performance of the ESP since 2004 shows an annual average return of 6.98%, compared to 6.57% of the benchmark. Since 2004, the portfolio has thus accumulated 273%, compared with a cumulative index performance of 246%. In the figures for the ESP, transaction costs and withholding taxes are deducted, whereas the benchmark index is calculated without costs.

In previous investment reports we have shown the cumulative performance since 1992, i.e. since we have pursued a uniform strategy with individual European equities. For the first time, we will limit ourselves to the figures since 2004, i.e. from the time when the current Salmann strategy, which is closely focused on the value style with the current selection criteria, has been applied.

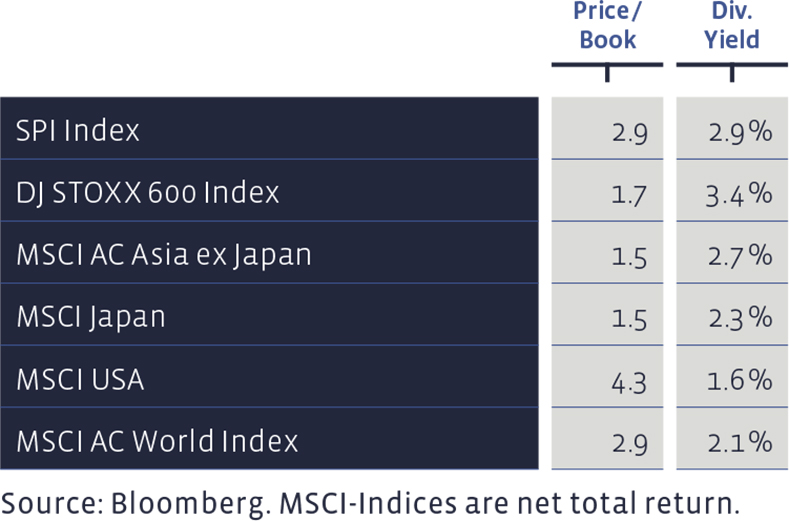

Price / Book and Dividend Yield of major equity markets:

Equities USA

Notwithstanding their high fundamental valuation compared to other countries, US equities have also had a buoyant quarter aside from the technology sector and were able to enjoy a double-digit semester performance. We have made no changes in US equities over the past twelve-week period and remain slightly overweight.

Equities Asia (ex Japan)

The Asian emerging markets were caught up in the economic slowdown in the industrialised nations in the past quarter. This tends to mean fewer exports for them. In addition, declining commodity prices weighed on their trade balances. So it is not surprising that these stock exchanges went into reverse gear. We have not made any changes and are neutrally weighted in this region of the world.

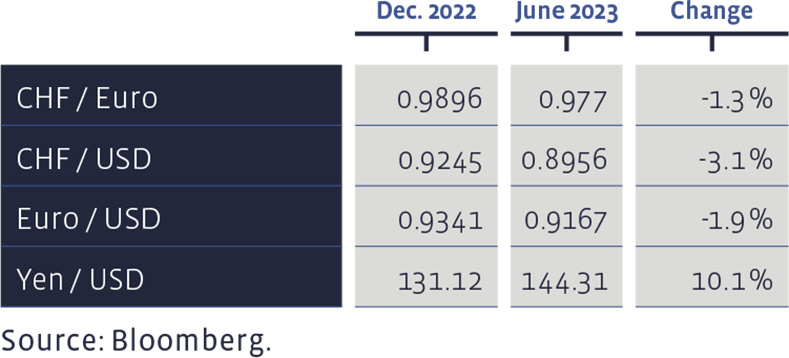

Since the beginning of the year, our selected currency rates have performed as follows:

Equities Japan

Japan's stock market is the talk of the town again. In the second quarter alone, foreign investors bought a net 39 billion US Dollars' worth of shares in the Land of the Rising Sun. The stock market in the Tokyo Kabutocho district has also generated attention because of statements by the investment legend, Warren Buffett, who said that after American stocks, Japanese shares now made up the largest position in the portfolio of his investment vehicle, Berkshire Hathaway.

Nippon is currently benefiting from economic growth above that of the USA, with low interest rates and low inflation. In addition, Japanese companies are increasingly making efforts to improve their corporate image, for example, through share buybacks and higher dividend payouts. We made no changes in the second quarter and remain slightly overweight here.

Alternative Investments

Alternative investments were more or less flat in terms of returns in the past quarter, as in the first half of the year. Our position (measured in US Dollars) performed slightly better than the benchmark index. We have not made any changes to the holdings and are therefore still underweighted in alternative investments.

Precious Metals

We currently do not hold any precious metal positions.

Summary of our current Asset Allocation: