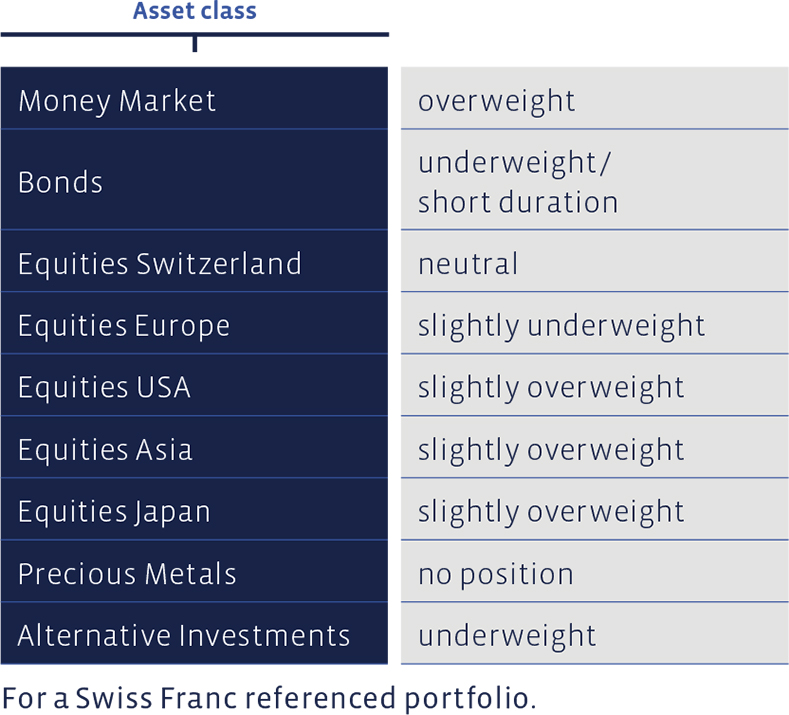

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings

Money market

In the fourth quarter, we did not make any active changes to the Swiss Franc-denominated mandates. On the other hand, we slightly reduced our cash holdings in US dollars and Euros and, in return, slightly increased our holdings in the corresponding bonds. Overall, however, we continue to be overweighted in liquid assets in all reference currencies.

Bonds

We did not actively change our positions in Swiss Francs and continue to be underweighted in bonds, albeit less significantly than before. Opportunities have arisen, especially for mandates in US dollars, to buy one or the other security and to extend the maturities slightly. This was less pronounced in Euros and Swiss Francs, but it can also be said that the investment drought in these two currencies, in which there were hardly any returns to be had, has come to an end.

Equities Switzerland

Our value stock selection, the "Swiss Stock Portfolio" (SSP), put in a final spurt in the fourth quarter in which it was able to distance itself from the benchmark. During this phase, our selection returned 7.7%, compared to the 4.3% gain of the Swiss Performance Index (SPI). The year-end surge was dominated by Bucher Industries (+24%), Vetropack (+23%) and Tecan (+20%). The taillights in the final quarter were held by Siegfried (-16%), Roche (-10%) and Coltene (-1%).

For the year as a whole, the SSP suffered a loss of 17.6%, the SPI one of 16.5%. Over the long term, the performance is clearly better. Since 2012, the average annual performance has been 11.4%, which clearly exceeds the average benchmark performance of 9%. Since 2012, this strategy has achieved a cumulative total performance of around 227%, while the index has achieved 157%. Transaction costs are deducted in the SSP figures, whereas the benchmark index is cost-free.

In the fourth quarter, we decided to change the orientation of the mandates in Swiss Francs that hold investment funds instead of direct investments. We sold the UBS tracker certificate on the SSP, which would have expired in 2023 anyway, in the fourth quarter. The fact that only the net amount after withholding tax could be credited with the incoming dividends proved to be a structural disadvantage in the long term, which, contrary to expectations, could not be compensated with disproportionate price gains.

Instead of the tracker certificate, a very cost-effective index fund is now used for the large-cap stocks (the so-called blue chips). Specifically, this is the CSIF Equity Switzerland Large Caps Fund.

For the mid- and small-capitalised Swiss equities, we now use the GAM Swiss Sustainable Companies Fund. In the course of this reallocation, the shares in the iShares Core SPI ETF were also sold in the aforementioned mandates with investment funds, because this equity would represent a duplicate of the index fund.

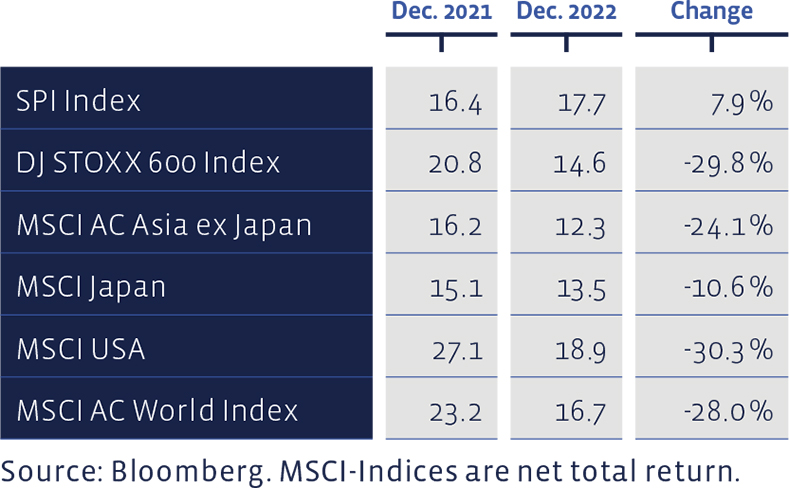

The price/earnings ratios based the latest 12 months profit figures, have mostly become cheaper:

Equities Europe

The European stock selection, the "European Stock Portfolio" (ESP), could not escape the adverse market situation, although it managed to catch up considerably in the last quarter. The performance in the last three-month period was +12.9%, which means that the selection outperformed the DJ Stoxx 600 Index (+9.8%).

The best-performing individual stocks for the quarter included Kindred Group, up 29%, BE Semiconductor (+27%) and A2A, up 24%. On the negative side, Neste (-4%), Persimmon (-2%) and Equinor (+1%) did not keep pace with the portfolio average or the overall market. The above changes are all expressed in Euros.

For the year, the ESP has a loss of 13.1%. The benchmark is down 10.6%. In the figures for the ESP, transaction costs and withholding taxes are deducted, whereas the benchmark index is calculated without costs.

The long-term performance of the ESP since 1992 shows an annual average return of 7.9%, compared to 6.7% for the benchmark. The portfolio has thus accumulated 955% since the beginning of the measurement period, compared to 647% for the cumulative index performance. The Performa European Equity Fund, which is used in fund mandates, achieved an excellent result with a virtually black zero.

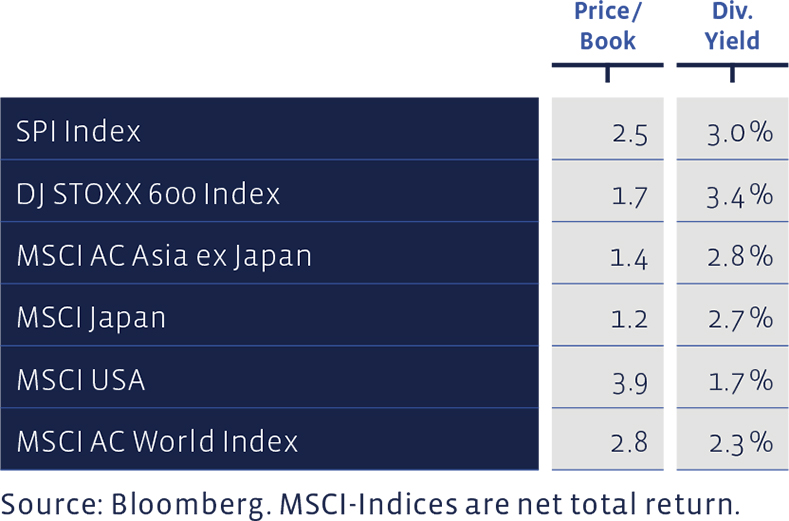

Price / Book and Dividend Yield of major equity markets:

Equities USA

Although America is doing better economically than the Old World and the United States is much further away from the war in Ukraine than Europe, the performance of American equities is even worse than those in other parts of the world. There are several reasons for this. On the one hand, the US Central Bank, the Fed, started raising key interest rates earlier, and it has now also raised them to a much higher level.

Currently, the rate for the US key interest rates, the Fed Fund Rate, is 4.5%. This compares with 2.5% currently set by the European Central Bank (ECB) and 1% being targeted by the Swiss National Bank (SNB). These sharp interest rate increases by the US Federal Reserve have massively deflated the previously high valuations of Wall Street's weighty high-tech giants.

The positions did not change in the fourth quarter. With regard to our Performa US Equity Fund, it should be noted that while the fund underperformed its benchmark in 2022, it performed excellently in 2021 (+24.4%), 2020 (+52.6%) and 2019 (+33.8%).

Equities Asia (ex Japan)

In China, the pendulum is clearly swinging towards a deterioration of the political landscape. At the last party congress, head of state, Xi Jinping, further concentrated and cemented his power. It seems that ideology now takes precedence over economic success.

China's behaviour towards Taiwan is also becoming more aggressive, and the alarm bells are also ringing regarding the Covid pandemic. All this makes us sceptical about China, which is why we intend to look at a possible change in Asian equities (excluding Japan) in the near future. Positions remained unchanged in the fourth quarter.

Equities Japan

Japan was one of the less affected equity markets in 2022. We made no changes in the fourth quarter and remain slightly overweight in the relatively attractively valued Japanese market.

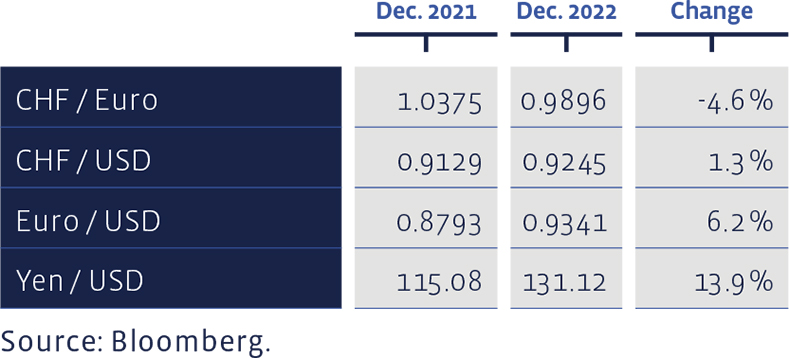

Since the beginning of the year, the selected foreign exchange rates have performed as follows:

Alternative Investments

This year, hedge funds have again achieved a relative out-performance compared to global equity and bond markets, thus fulfilling their diversification task, although one admittedly could have wished for a rather better result. The asset class did not change in the fourth quarter.

Precious Metals

Currently, we do not hold any precious metals in the portfolios. After we halved the Gold positions in the second quarter with respectable gains and gave them up completely in July, Gold plunged as a result of the steep rise in interest rates in the USA. With the interest rate rise in America now seemingly flattening out, investors regained hope in November and December and helped the yellow metal to recover.

Summary of our current Asset Allocation: