At its meetings, our Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

still slightly overweight in equities

We continue to view equities as a more attractive asset class than bonds. On the one hand, the average (dividend) return is significantly higher than the yield level of bonds, whilst on the other, shares in quality companies also offer better inflation protection compared to fixed-interest investments.

Money market

We currently hold a slightly higher volume in account balances and interest-bearing call money investments in the reference currency, in readiness to seize suitable investment opportunities as they arise.

Bonds

USD bonds remain very attractive due to the higher yields on offer. We are retaining a 4% allocation in this segment as part of the asset allocation. Bonds in CHF or EUR have benefited from the interest rate cuts by the central banks, but are now becoming less attractive at this yield level. We use two special funds in this asset class as an additional investment and to increase returns.

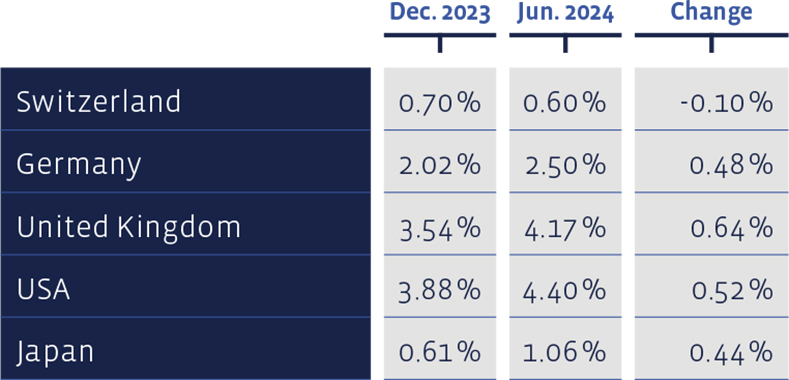

Yields on ten-year government bonds have risen slightly since the beginning of the year:

Equities Switzerland

The Swiss Performance Index (SPI) rose by 3,09% over the last three-month period. Our stock selection based on value criteria, the "Swiss Stock Portfolio" (SSP), posted an overall performance (price changes plus dividends) of 2,22% in the second quarter and thus lagged slightly behind its benchmark.

The shares of the two newcomers EFG International (+23%) and Swissquote (+17%) as well as the IT wholesaler Also (+15%) performed particularly well in the SSP in the past quarter. At the other end of the ranking are Tecan (-19%), Lonza (-9%) and UBS (-7%).

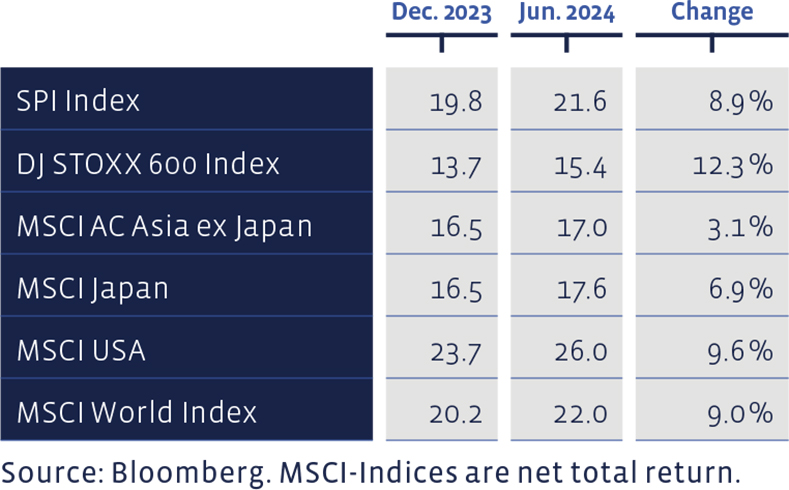

The price/earnings ratios based on the latest 12 months profit figures, have increased:

Over the long term, the SSP has performed exceptionally well. Since 2012, the average annual performance has been 10.35%, significantly outperforming the median benchmark performance of 8.43%. Since 2012, the SSP has achieved a cumulative total performance of around 278%, compared with 198% for the index. Transaction costs are deducted in the SSP figures, whereas the benchmark index is calculated without costs.

Equities Europe

Over the past three months, the European equity markets of the Nordic countries as well as the UK, where the Brexit hangover is slowly subsiding on the back of encouraging economic data, have been particularly encouraging. French equities are at the other end of the popularity scale this time. The possible political upheaval is causing uncertainty in the "Grande Nation" and has led to falling share prices on the Paris stock exchange.

Our European direct investment selection, the "European Stock Portfolio" (ESP), which is based on fundamental valuation criteria, was affected by the falling prices of French quality stocks. The ESP returned a negative performance of 2,20%, while the overarching benchmark Stoxx Europe 600 gained 1,10% over the same period.

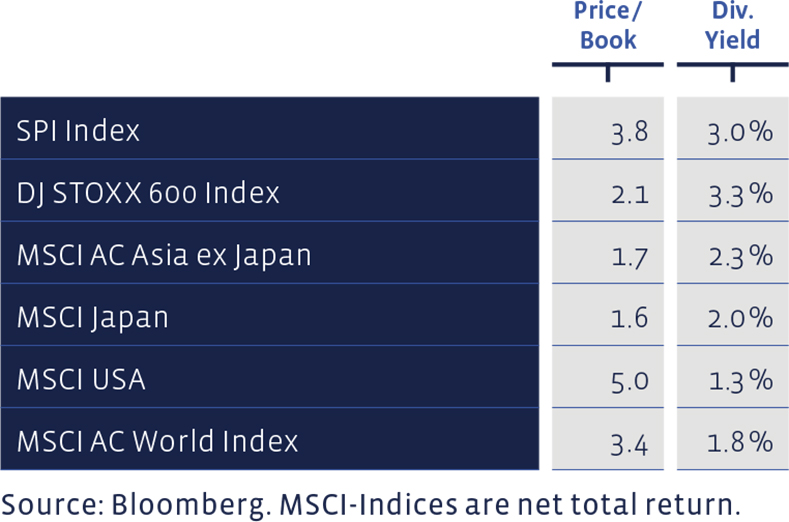

Price / Book and Dividend Yield of major equity markets:

Among the best performers in our European selection were ASML Holding (+11%), Novo Nordisk (+9%) and Informa (+3%). The worst performers were Banco Santander (-10%), SEB SA (-14%) and Eiffage (-15%). The figures are given in the respective local currencies.

The long-term performance of the ESP since 2004 shows an average annual return of 6,64%, compared with 6,91% for the benchmark. The portfolio has accumulated a total of 273% since 2004, compared with a cumulative index performance of 293%. Moreover, transaction costs and withholding taxes have been deducted from the figures for the ESP, whereas the benchmark index is calculated without costs

You will find more on the performance of the SSP and ESP that can be tracked at any time on our website www.salmann.com in the "Investment strategies" section.

Equities USA

At first glance, the US stock market has had a fantastic first half of the year. However, a closer look reveals that not all that glitters is not "gold". The most recent upward spike in June in particular clearly shows this; while the market capitalisation-weighted S&P 500 gained an impressive +3,5%, the equally weighted index was down 0,6%. This means that the very strong performance of the S&P 500 is once again being driven by just a few large IT and communications companies.

Equities Asia (without Japan)

Led by India (+10,6%) and China (+7,9%), the Asian equity markets experienced a very strong quarter. The multi-country MSCI AC Asia ex -Japan rose by 7,2%. We made no changes to our positions in Asia.

Equities Japan

The Japanese stock market continues to benefit from a weakening yen and a slight rise in inflation. The rise in Japanese equities in the second quarter levelled off noticeably to +1.5%. However, the accumulated annual gain of +18.7%, as measured by the Topix Index, is impressive. The equity fund we invested in clearly outperformed the market at 3%.

Alternative Investments

We are currently only invested in the AXA Cat Bonds Fund and are underweighted in alternative investments. The fund invests in bonds that reinsure clearly defined loss events from natural disasters. This investment segment currently has an attractive premium-risk ratio.

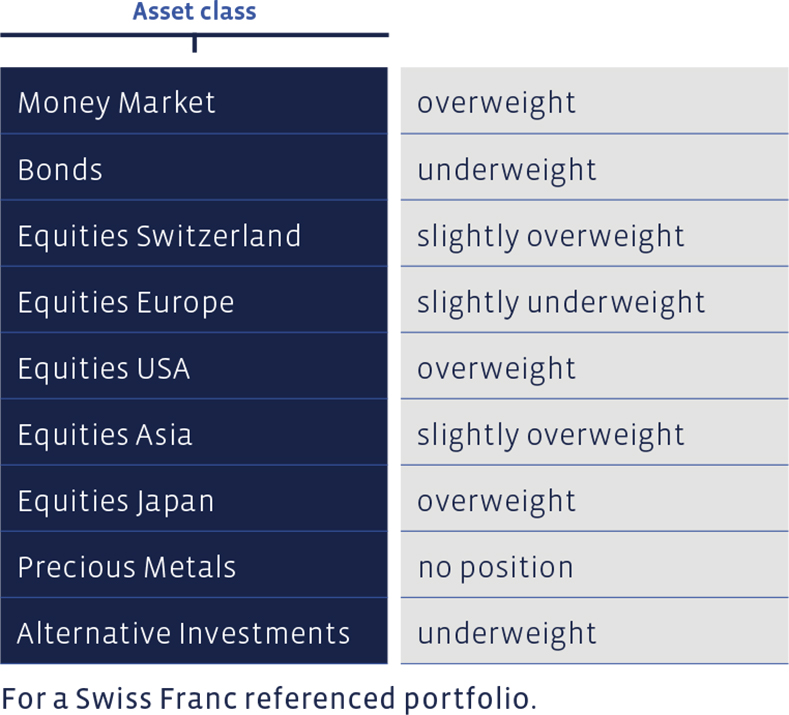

Summary of our current Asset Allocation:

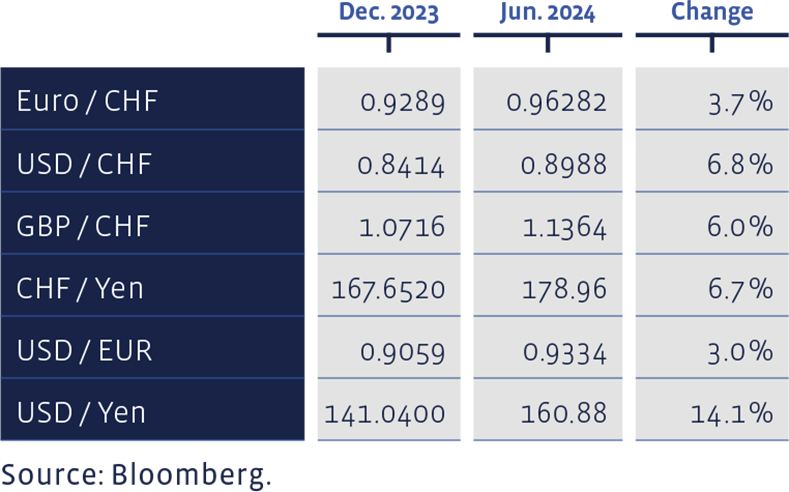

Since the beginning of the year, selected exchange rates have trended as follows: