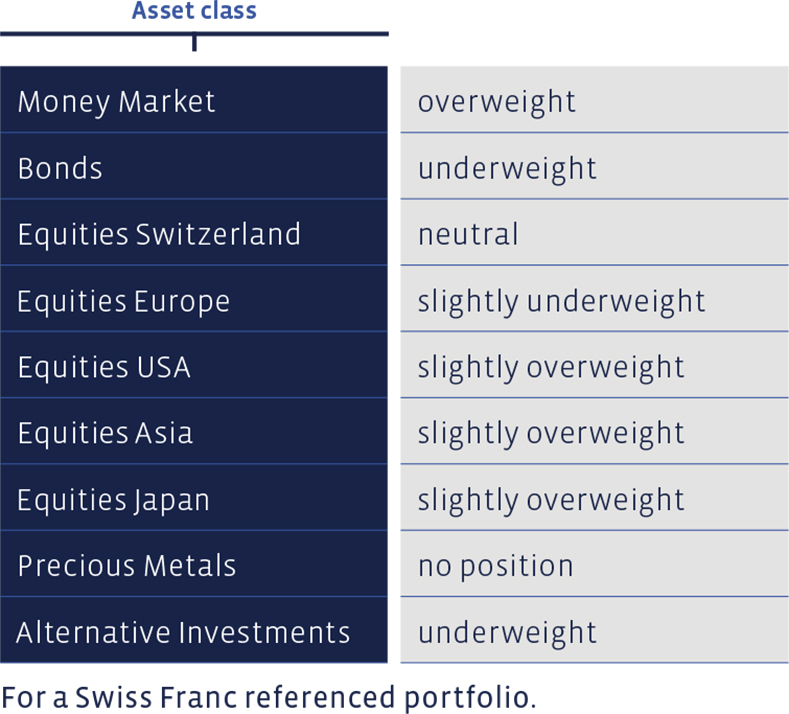

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

Money market

Overall, the overweighting of liquid assets did not change during the reporting period. Above a certain amount, generally 100,000 Swiss Francs or more, liquid assets can now also be invested again in interest-bearing call and time deposits.

Bonds

We remain underweighted in bonds, but have decided to slowly increase the duration (weighted residual maturity) somewhat in Swiss Franc and Euro mandates. In USD mandates, this step has already been taken. For the Swiss Franc and Euro mandates, this means that we will replace maturing bonds with bonds with a slightly longer residual maturity, so that the duration of all bonds can increase slightly on average.

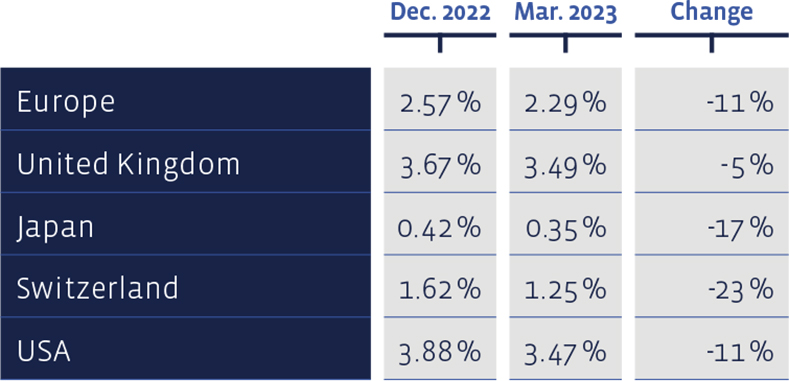

Since the beginning of the year, yields on ten-year government bonds have fallen everywhere:

Equities Switzerland

Our value stock selection for the domestic market, the "Swiss Stock Portfolio" (SSP), performed extremely well in the first quarter. It generated an overall performance (price changes plus dividends) of 12.8%, outperforming its benchmark, the Swiss Performance Index (SPI), by a full 6.9 percentage points. No changes were made to the position size, maintaining the roughly neutral weighting. The Coltene shares were sold, because sufficient market breadth was becoming less and less of a given for us.

Long-term performance is also very good. Since 2012, the average annual performance has been 12.3%, significantly outperforming the median benchmark performance of 9.3%. Since 2012, this strategy has achieved a cumulative total performance of approximately 269%, while the index has achieved one of 172%. Transaction costs are deducted in the SSP figures, whereas the benchmark index is cost-free.

On the Swiss equities market, mid-cap companies performed best during the reporting period (+10%). As a group, they outperformed the large- and small-capitalization companies, each advancing by around 5% as a group. Among the heavyweights, Novartis shares stood out with a performance of +15%. Positive study results of a breast cancer drug helped their performance here.

An even better performance was achieved by the industrial sector, with Zehnder (heating & ventilation) rising by 37%, SFS (precision components/fastening) by 35%, and Vetropack (glass packaging) by almost 28%. On the losing side, in addition to Roche (-7%), were Cembra Money Bank (-7%) and the laboratory equipment supplier Tecan (-3%).

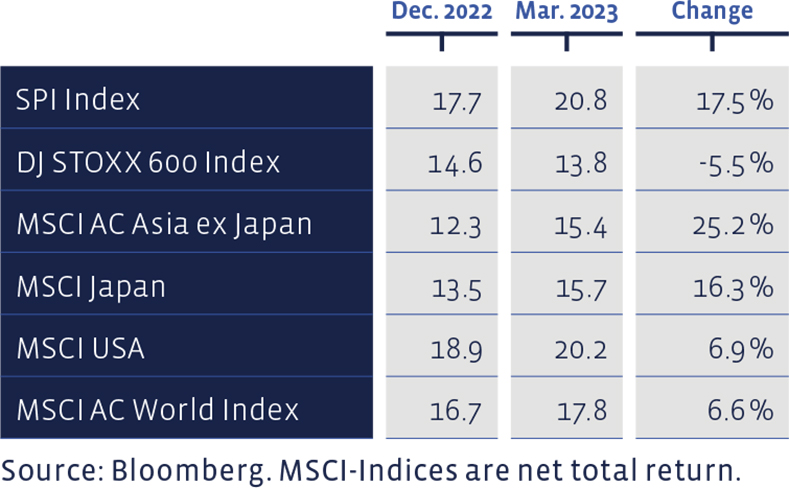

The price/earnings ratios based the latest 12 months profit figures, have mostly increased:

Equities Europe

The European dividend stocks also ended the first three-month period of the year with unchanged positions and thus slightly underweight. The European stock selection, the "European Stock Portfolio" (ESP), returned 6.2%, while the benchmark DJ Stoxx 600 Index returned 8.4%.

The best performing stocks included the semiconductor company, BE Semiconductor (+42%), the mining company SSAB (+34%) and Deutsche Post (+22%). Meanwhile, bringing up the rear in the first quarter were stocks in the Norwegian energy group Equinor (-15%), IG Group (financial sector, -11%) and Logitech (-7%), the manufacturer of computer technology.

The long-term performance of ESP since 1992 shows an annual average return of 8%, compared to 6.9% of the benchmark. The portfolio has thus accumulated 1,020% since the beginning of the measurement period, compared with a cumulative index performance of 710%. In the figures for the ESP, transaction costs and withholding taxes are deducted, whereas the benchmark index is calculated without costs.

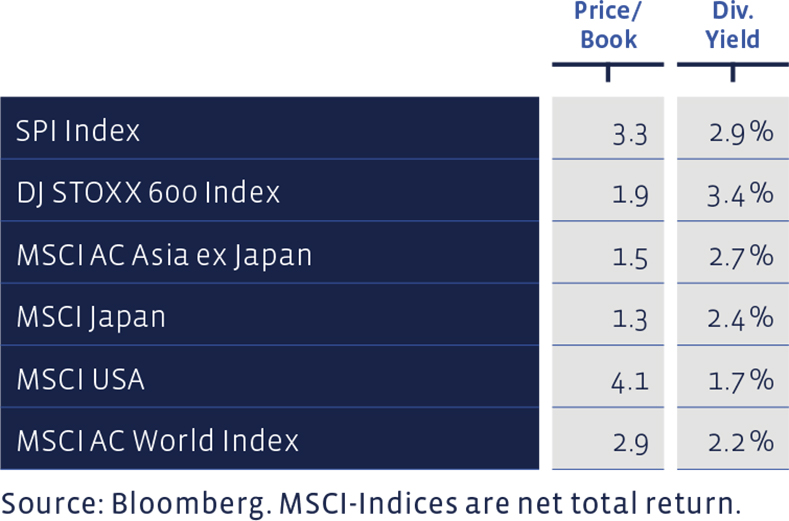

Price / Book and Dividend Yield of major equity markets:

Equities USA

Has the Fed overdone it with its interest rate hikes (the fastest and most marked increase in the Fed Funds rate in the last 40 years, with 9 hikes in a row)? Some say yes. They point to the severe financial turmoil seen at American regional banks, where the first fatalities have already been reported. No, say others, who point to the persistently tight labour market and stubborn inflation rate despite the downward trends. The Wall Street Journal called the latest increase a "high-wire act".

In the fourth quarter of 2022, sales per share of S&P 500 companies fell compared to the previous quarter for the first time since the outbreak of the pandemic. While the decrease is small, it could be an indication that earnings are coming under pressure. Based on the overall index, according to «Bloomberg», the market consensus was not expecting earnings per share growth at the moment. Given the numerous uncertainties and the not-cheap valuations, a wait-and-see attitude seems to be justified for US equities. We have made no changes in US equities in the past twelve-week period.

Equities Asia (ex Japan)

In January, we decided to halve the position held in the Aberdeen Asia Pacific Fund and invest the proceeds in the Franklin Templeton India ETF. In the Aberdeen Fund, the allocation to Chinese equities is about 25%. Since the last party congress in China, we believe the pendulum has swung towards a deterioration in the political environment. Xi Jinping has further centralised and cemented his power. It seems that ideology now takes precedence over economic prosperity. China is also behaving more aggressively towards Taiwan.

All this makes us sceptical about the Middle Kingdom, which is why we have made the shift. India is likely to replace China as the world's most populous country this year. The Indian population is on average much younger than the Chinese, the economy is far from having exhausted its potential and is growing fast. According to forecasters surveyed by “Bloomberg”, India's GDP is expected to grow by 6% or more this year and next, outpacing China's expected growth.

Equities Japan

We remain neutral on Japan. We made no changes in the first quarter and remain slightly overweight in the relatively attractively valued Japanese market

Alternative Investments

Alternative investments did not make any big splashes in the first quarter and were treading water. In a multi-year comparison since 2016, the BCV Liquid Alternative Beta Fund has beaten both the relevant indices and representative competitor products in terms of performance. We have not made any changes to the positions and are therefore still underweighted in alternative investments.

Precious Metals

We currently do not hold any precious metal positions.

Summary of our current Asset Allocation: