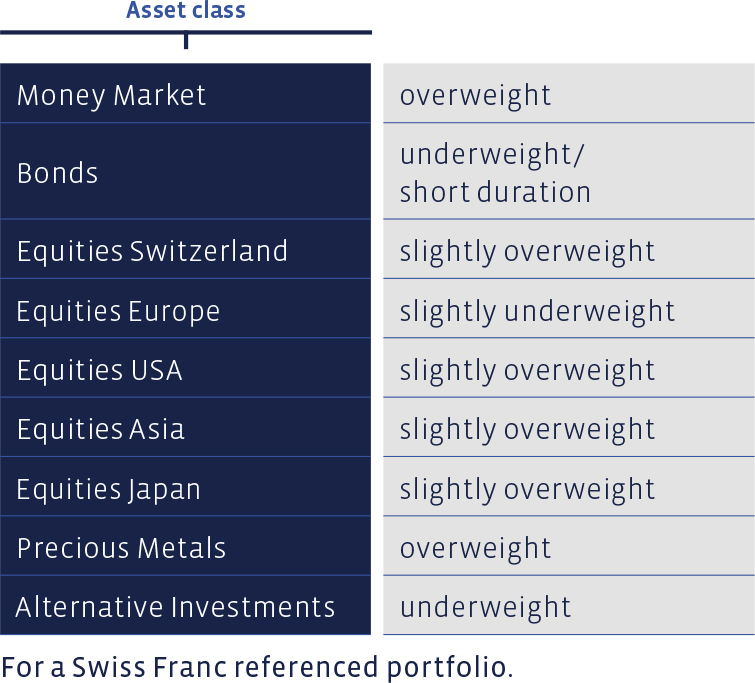

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions. Mandates in different reference currencies at times display varying nominal weightings and weighting changes.

Money Market

By divesting part of the alternative investments, we have increased the liquidity ratio by around three percentage points and are now overweighted here. Part of the liquid assets could be invested in equities if necessary, if the development of the economic and geopolitical situation indicates that this is appropriate.

Bonds

The rise in interest rates has driven bond prices down across the board. The fact that bonds of Russian borrowers, for example Gazprom or the Russian state railway, are also listed on the Swiss and European markets has had an additional negative impact in some cases. Direct exposure to Russian debtors can also occur here, as these securities were part of the benchmark until the start of the war and offered a yield benefit. However, they are the exception. For such reasons, the Acatis IfK Value Renten Fund, among others, also holds these bonds, although the holding was around 7% before the outbreak of the war. Trading in these securities is non-existent at the moment, and prices are therefore at a very low ebb.

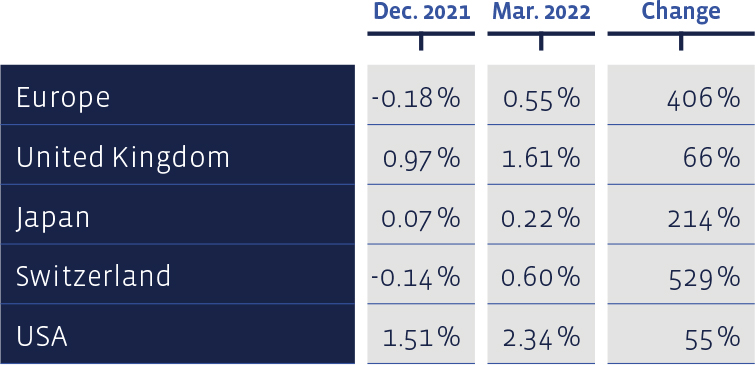

Since the beginning of the year, yields on 10-year government bonds increased everywhere:

Equities Switzerland

Swiss equities were unable to escape the negative trend. The widely based Swiss Performance Index (SPI) fell by 5.51%. Our "Swiss Stock Portfolio" (SSP), which is compiled according to value criteria, lost 6.25%. The figures are total returns, namely price changes plus any dividends.

Amongst the best performers during this reporting period were Helvetia (+12.3%), Sonova (+8.3%) and Swisscom (+7.9%). Tecan (-33.7%) and Vetropack (-24.7%) brought up the rear. The former suffered because demand for PCR tests slumped and results fell short of analysts' high expectations. Vetropack is directly affected by the war because it has a production facility in Ukraine that had to cease operations.

Over the long term, the performance of the "Swiss Stock Portfolio" continues to be very pleasing. Since 2012, the average annual performance of the SSP amounts to 13.7%, which clearly exceeds the average benchmark performance of 11%. Since 2012, this strategy has achieved a cumulative total performance of around 272%, compared to 191% for the index. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

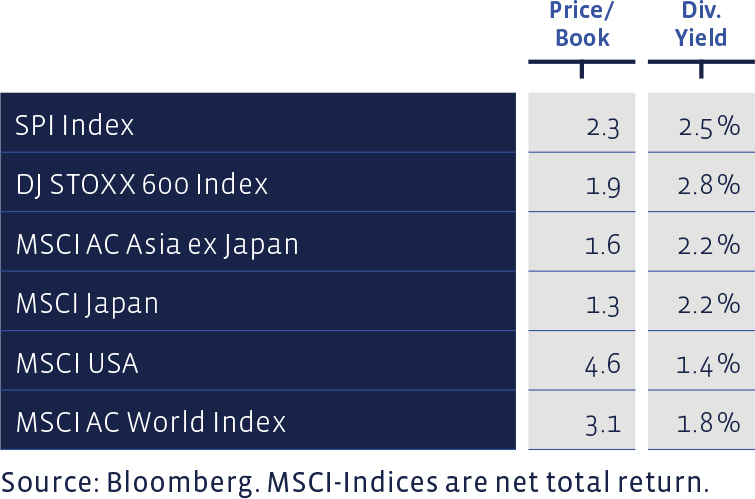

Measured on the price/earnings ratio using the latest 12 months profit figures, all equity markets have become cheaper:

Equities Europe

European equities have also had to bear the brunt of the war in Ukraine. The DJ Stoxx 600 Index ended the first quarter at -6.02%. Our European stock selection, the "European Stock Portfolio" (ESP), closed the same period at -6.69%. Transaction costs and withholding taxes are deducted from the ESP figures, whereas the benchmark index is calculated without costs.

Commodity-related equities were among the best performers, notably Aurubis (copper) with a gain of almost 25%, and Rio Tinto (mining) with a gain of over 23%. The company hardest hit by the war was the Finnish tyre manufacturer, Nokian Renkaat, which operates a large factory in Russia that is now shut down.

The long-term ESP performance since 1992 continues to speak in favour of the value style applied in this selection. Over this period, ESP has achieved an average annual performance of 8.36% compared to 7.05% for the benchmark. The portfolio has thus accumulated 1,033%, whereas the cumulative index performance is "only" 685%.

Price / Book and Dividend Yield of major equity markets:

Equities USA

On the American stock markets, the gap between the growth stocks of the Nasdaq technology exchange and the broader market widened even more in the first quarter. While many of the previously very highly valued growth stocks on the Nasdaq were hit hard by the rise in interest rates and the related worsening conditions for discounting profits in the distant future, the broader market was supported by equities in the oil and gas sectors, as well as other defensive industries. There were no changes in the positions in the first quarter.

Equities Asia (ex Japan)

The positions in Asian equities (excluding Japan) also remained unchanged. Some markets in this region of the world lost less in the first quarter than, for example, European markets, or even closed this reporting period with a plus. The slight overweighting of Asian equities has not changed.

Equities Japan

In the first quarter, equities in the Land of the Rising Sun also benefited from Japan's great distance from the theatre of war. The positions have remained unchanged, maintaining a slight overweight

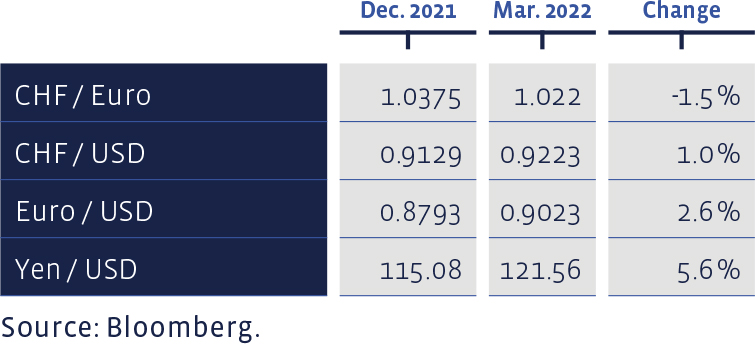

Since the beginning of the year, the selected foreign exchange rates have performed as follows:

Alternative Investments

This asset class has clearly outperformed equities, for example. In order to create liquidity for a possible increase in the equity allocation, we reduced the position during the quarter by selling the Franklin Templeton K2 Alternative Strategies Fund. As a result, we are now underweight in alternative investments.

Precious Metals

Precious metals were in strong demand as a safe haven in the first quarter. At times, the price of the fine ounce of gold was quoted near the historic high of USD 2,070, before falling slightly towards the end of the month. Since the beginning of the year, the performance of the ZKB Gold ETF held in the portfolios is around 7.4%. The position is unchanged and thus overweighted.

Summary of our current Asset Allocation: