At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios not subject to client's restrictions. Mandates in other reference currencies show partially deviating changes and weightings.

Money market

In alternative investments, we made a sale so that we are slightly overweighted in liquidity in the short term. We are already planning a new investment and will reduce the allocation to neutral again.

Bonds

USD bonds remain very attractive due to the higher returns. We are retaining a 4% allocation in this segment as part of the asset allocation. Bonds in CHF have benefited from the interest rate cut by the SNB but are now becoming less attractive at this yield level. We are using two special funds in this asset class as an "add-on" and to increase returns.

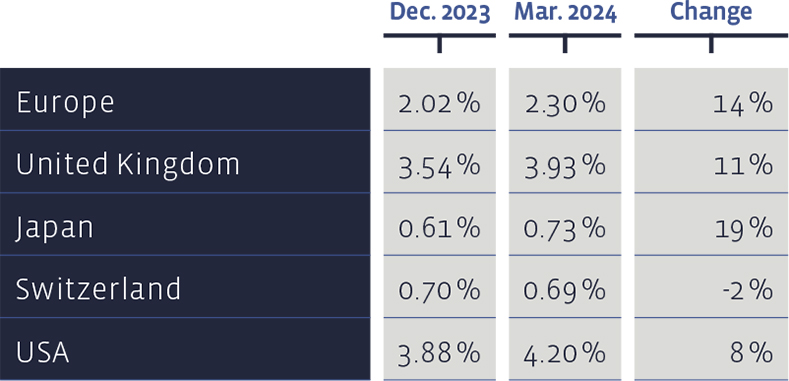

Yields on ten-year government bonds have risen slightly since the beginning of the year:

Equities Switzerland

The Swiss Performance Index (SPI) rose by 5.98% over the last three-month period. Our stock selection based on value criteria, the "Swiss Stock Portfolio" (SSP), achieved an overall performance (price changes plus dividends) of 4.59% in the first quarter and thus lagged slightly behind its benchmark.

The shares of Lonza (+53%), Holcim (+24%) and Alcon (+14%) performed particularly well in the SSP in the past quarter. Vetropack (-17%) and Swatch (-8%) bring up the rear.

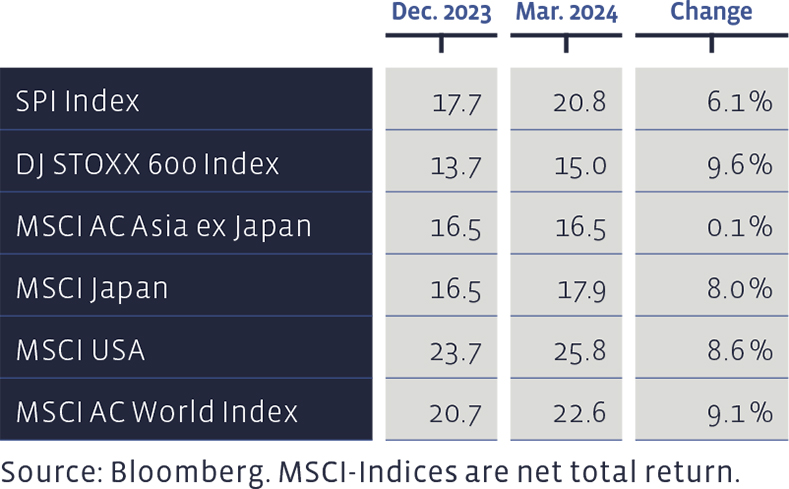

The price/earnings ratios based the latest 12 months profit figures, have varied in performance:

Over the long term, the SSP has performed exceptionally well. Since 2012, the average annual performance has been 10.37%, significantly outperforming the median benchmark performance of 8.34%. Since 2012, this strategy has achieved a cumulative total performance of around 270%, compared with 189% for the index. Transaction costs are deducted in the SSP figures, whereas the benchmark index is calculated without costs.

Equities Europe

Big is beautiful", in other words, in Europe, the large companies outperformed the market as a whole. Accordingly, the EuroStoxx 50 gained +12.8% and beat the overall StoxxEurope 600 index, which advanced by "only" 7.7%. The Nordic stock exchanges were up 6.8% and the Swiss stock market 6.0%. The British stock exchange was at the bottom of the chart with a price advance of 2.8%. In addition to the size criterion, growth stocks (STOXX Europe Growth +9.0%) were also favoured over value stocks (STOXX Europe Value +5.8%).

Our European direct investment selection, the "European Stock Portfolio" (ESP), which is based more on fundamental valuation criteria (value approach) than on growth and market capitalisation, was unable to benefit from the hype surrounding the large-cap stocks. Over the entire 1st quarter, the ESP remained in negative territory at -2.15%.

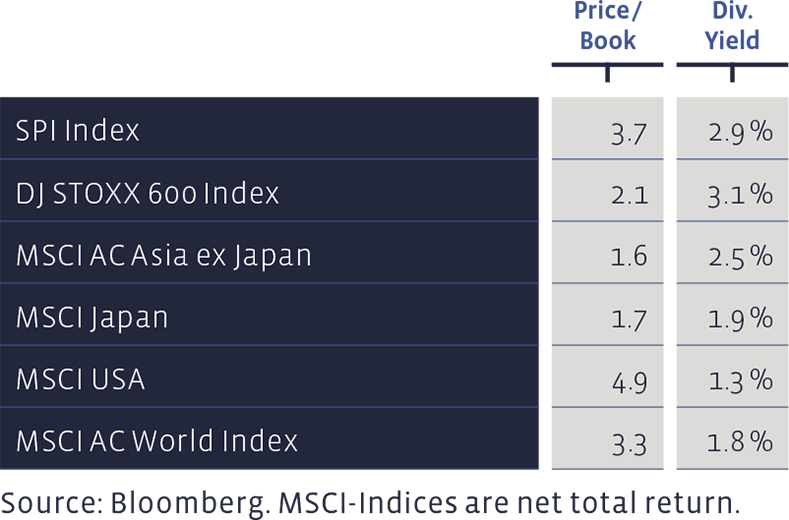

Price/Book ratios and Dividend Yield of major equity markets:

The best performers in our selection in the first quarter included Repsol (+20.6%), Hannover Re (+17.3%) and MAN Group (+16.5%). The figures are given in the respective local currencies. The worst performers were STM Microelectronics (-11.5%), Barrat Developments (-14.3%) and AP Moeller Maersk (-21.7%).

The long-term performance of the ESP since 2004 shows an average annual return of 6.84%, compared with 6.93% for the benchmark. The portfolio has thus accumulated a total of 282% since 2004, compared with 288% for the cumulative index performance. Moreover, transaction costs and withholding taxes have been deducted from the figures for the ESP, whereas the benchmark index is calculated without costs. The performance of the SSP and ESP can also be tracked at any time on our website www.salmann.com in the "Investment strategies" section.

Equites USA

The US equity market remains robust. The upward trend that began in the last quarter of 2023 continues this year. All the major US indices have reached new all-time highs. Fundamental valuations (e.g. price/earnings ratio) are now slightly higher in a 10-year comparison due to the price advances. In terms of market technique, the strong momentum of the US market is striking. The clear outperformance of large companies compared to small caps and growth stocks compared to value stocks continues.

Equities Asia (without Japan)

We repositioned ourselves in Asian equities at the end of 2023. In addition to our long-standing position in the Barings Asean Fund equity fund, which contains equities from emerging countries in Southeast Asia, we are invested in Indian and Vietnamese equities through two country funds. By deliberately focussing on these two countries, we hope to benefit from the relocation of production from China to alternative locations.

Equities Japan

The Japanese stock market is benefiting from a weak yen and, grotesquely, rising interest rates. The trade union umbrella organisation, Rengo, has negotiated wage increases of over 5%. This will increase the purchasing power of Japanese consumers and also fuel inflation, which will be a positive support for Japanese equities after many years of deflation, as long as the increase remains moderate and controlled by the Japanese central bank.

Alternative Investments

In February, we decided to purchase the AXA Cat Bonds Fund. The fund invests in bonds that reinsure clearly defined loss events from natural disasters. This investment segment currently has an excellent premium-risk ratio. At our investment meeting in March, we also decided to sell the holdings in BCV Liquid Alternative Beta A.

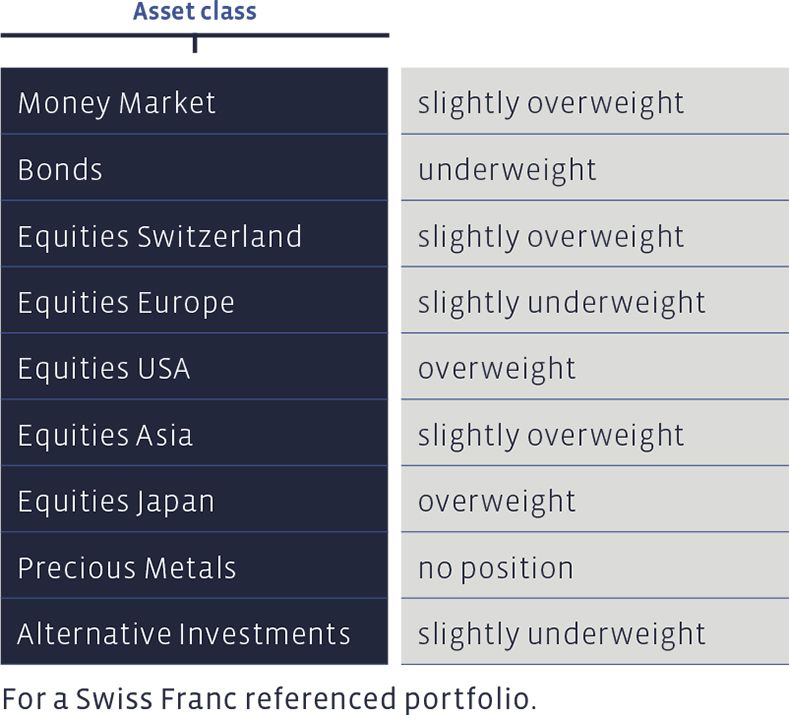

Summary of our current Asset Allocation: