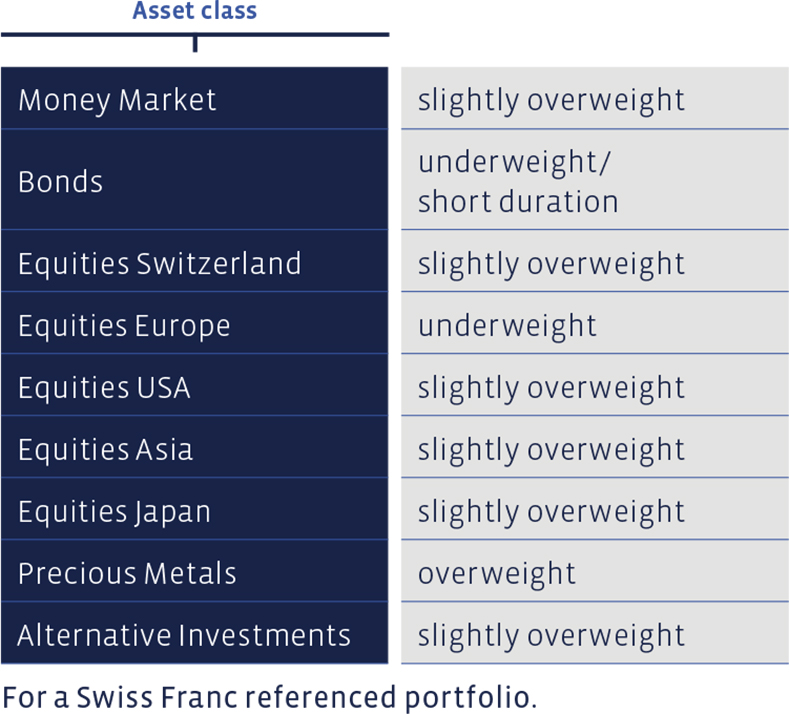

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions. Mandates in different reference currencies at times display different nominal weightings and weighting changes

Money Market

There have been no significant changes here, which means that we are slightly overweight in cash.

Bonds

Although prices have fallen a little and yields have risen slightly, bonds remain a tough investment environment. We remain true to our strategy, which is "none or hardly any government bonds, low duration, residual maturities of no more than five years if possible, and a spread across all maturities". We have not made any changes to the positions and are therefore underweight.

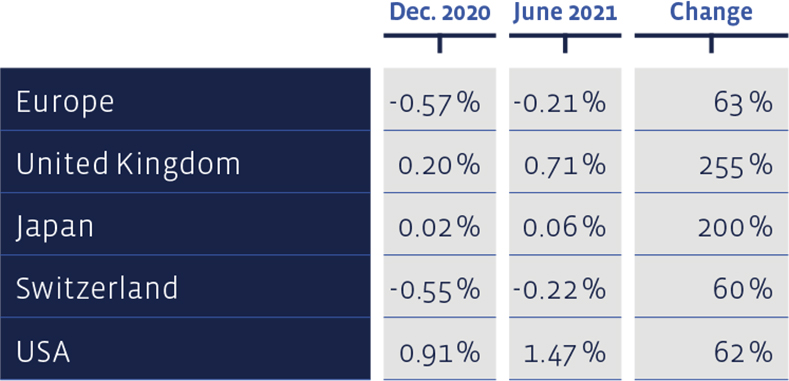

During the course of the year, yields on 10-year government bonds increased everywhere:

Equities Switzerland

Swiss equities once again radiated in their best light and ended the quarter, as measured by the Swiss Performance Index (SPI), well ahead of the field with a 9.5% performance sprint. This brings the total performance for the first semester to 15.2% (price gains plus dividends).

The annual rebalancing has slightly altered our selection of the most attractive Swiss value equities, the Swiss Stock Portfolio (SSP). The equities of Forbo, Schweiter Technologies, SFS Group, Swiss Re, Tecan and Zehnder are new additions. No changes were made to the equity holdings in the Commodities and Industrial sectors, in Holcim and Vetropack, in the Consumer Goods sector, in Bell Food, Emmi, Nestlé and the Swatch Group, and in the Technology sector, in Also and Swisscom. Among the financials, Cembra Money Bank, Helvetia and Swiss Life continue to be included, while in the pharmaceuticals/healthcare sector Alcon, Coltene, Novartis, Roche, Siegfried, Sonova and Vifor Pharma remain. Adecco and Baloise have been removed from the portfolio.

In the first half of the year, the "Swiss Stock Portfolio" (SSP) gained 15.04%, roughly matching the index. Sonova, Swatch and Zehnder were the best performers in the portfolio in the second quarter. The figures are total return, i.e. share price changes plus any dividends.

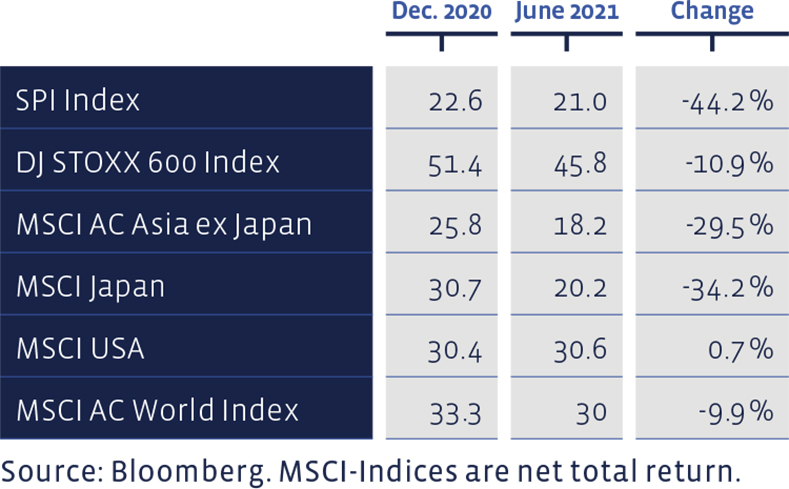

Measured on the Price/Earnings ratio using the latest 12 months profit figures, equity markets have developed differently:

For the "Strategy Certificate linked to the SIM-Swiss Stock Portfolio Basket" certificate based on the SSP (Valor: 36524524, ISIN: CH0365245247), the performance for the first half of the year amounts to a plus of 13.8%.

Over the long term, the performance of the "Swiss Stock Portfolio" continues to be excellent. Since 2012, the average annual performance of the SSP has been 15.08%, significantly outperforming the average benchmark performance of 11.75%. Since 2012, the total cumulative return of this strategy amounts to around 280%, while that of the index is 187%. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

Equities Europe

Our European stock selection, the European Stock Portfolio (ESP), was also rebalanced in the Spring. Rio Tinto and Skanska (mining and industrial, respectively), the consumer-related Ahold Delhaize and Kindred Group, as well as the insurance equity, the Phoenix Group, are now among the fundamentally most attractively valued stocks. Equities in the chemical company, Yara International, and the technology equities United Internet and Sopra Steria Group have also made it onto the list.

Aurubis, ASM International and A2A, as well as Barratt Developments, British American Tobacco and Covestro have retained their places in the selection. Diasorin, Hikma Pharmaceuticals, IG Group and Legal & General also remain in the portfolio. Neste, Nokian Renkaat, Persimmon, Randstad, Recordati and Swatch Group as well as Tate & Lyle are also part of this value stock selection. No longer included are Amsterdam Commodities, Dialog Semiconductor, Enagas, Fuchs Petrolub, Jupiter Fund Management, Siltronic, Taylor Wimpey and Terna.

The ESP achieved a total performance (price changes plus distributions) of 14.56% in the first half of the year, slightly less than the Dow Jones Stoxx 600 Index (15.15%). In the figures for the ESP, transaction costs and withholding taxes are deducted, whereas the reference index is calculated without costs. The total cumulative performance of the ESP since 1993 amounts to about 1,081%, while that of the benchmark to about 671%, or 8.73% respectively 7.17% annualised.

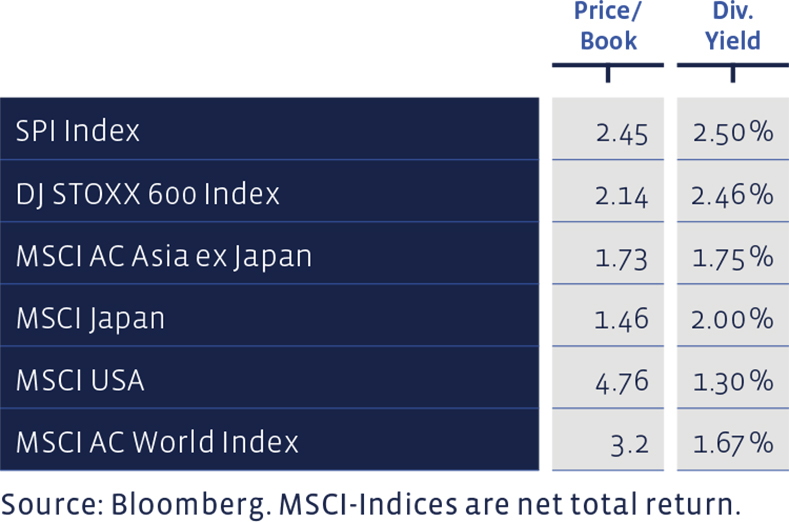

Price / Book and Dividend Yield of major equity markets:

Equities USA

Despite their lofty valuations, US equities continued to climb steadily in the second quarter. This was helped not least by the high earnings growth that US companies are returning. With regard to the market as a whole, analysts estimate an increase in earnings per share of 30% for 2021, which is significantly more than at the beginning of the year. The positioning has remained unchanged, which means we are slightly overweight.

Equities Asia (ex Japan)

We are also slightly overweight in Asian equities (excluding Japan). The positions have not changed. Compared to Europe and America, events in the Far East simmered on a low heat during the reporting period.

Equities Japan

The Japanese market did not shatter records in either the second quarter or the first half of the year, but is still clearly up. The positions are unchanged and thus slightly overweight.

Alternative Investments

Hedge funds, measured against the global hedge fund index, gained 2.4% in the second quarter and are up 3.7% for the semester. Some of the instruments we use significantly beat this performance (BCV Liquid Alternative Beta Fund), while others fell short (see table "Other funds we use"). The positions were not changed in the last three-month period.

Precious Metals

For once, Gold is bringing up the rear. The rise in interest rates, the (superficial) calm on the political stage as well as increasing confidence that the pandemic can be pushed back more and more, thanks to progress in vaccinations, have slowed down the rush of investors into the safe haven that is Gold. We have left the positions unchanged.

Summary of our current Asset Allocation:

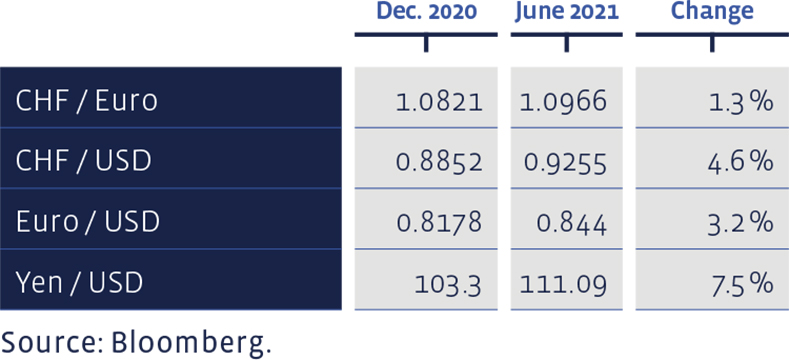

Since the beginning of the year, selected foreign exchange rates have developed as follows: