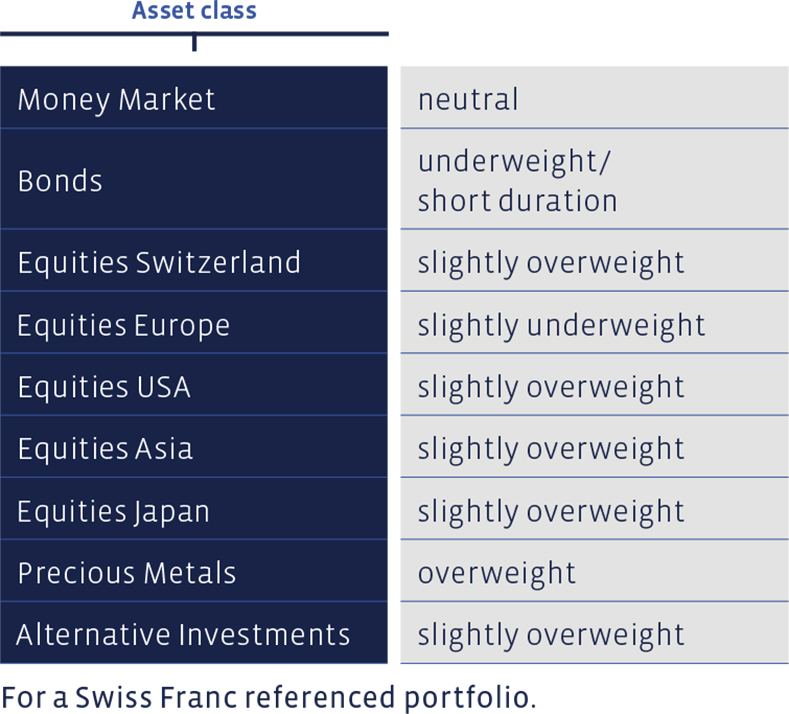

At its meetings, the Investment Committee decided on the following changes to the asset allocation for medium-risk balanced Swiss Franc portfolios, not subject to client’s restrictions. Mandates in different reference currencies at times display varying nominal weightings and weighting changes.

Money Market

The percentage rate lies approximately within the range of a neutral weighting. No active changes were made in the past quarter. As is widely known, there has been no return in this asset class for a considerable time. Nevertheless, the asset class is still required, as it serves as a buffer against value fluctuations in other categories and as a reserve in order to be able to react quickly to opportunities as they arise.

Bonds

We have also made no changes to the bond positions The current weighting of fixed-interest securities remains below the long-term strategic level. Maturities that are staggered and not too long remain the order of the day, as does a good spread of credit ratings.

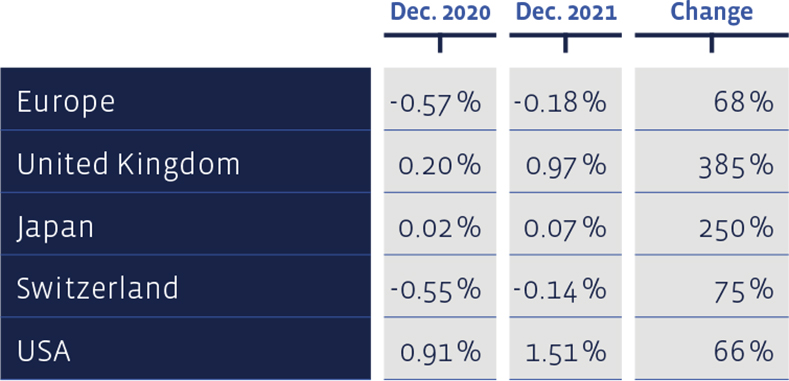

Since the beginning of the year, yields on 10-year government bonds increased everywhere:

Equities Switzerland

Swiss equities had a very pleasing fourth quarter, which more than compensated for the drop experienced in the late summer. The year as a whole has been even more impressive. While the Swiss Performance Index (SPI) gained 9.3% in the last three-month period, it rose a respectable 23.4% for the year as a whole. Our "Swiss Stock Portfolio" (SSP), which is compiled according to value criteria, was not quite able to keep pace and closed the year 2021 with a plus of 20.3%. The figures are total returns, i.e., price changes plus any dividends.

In addition to the Index heavyweight, Nestlé (annual performance 25.4%), Sonova (+57%), Swiss Life (+42%) and Siegfried (+37%) were particularly impressive performers in the portfolio over the course of the year. Newcomer Tecan (+36% since purchase in May) also cut a fine figure. At the other end of the spectrum, the red lantern went to Cembra Money Bank (-36%), where the surprising end to the collaboration agreement with Migros caught investors on the wrong foot.

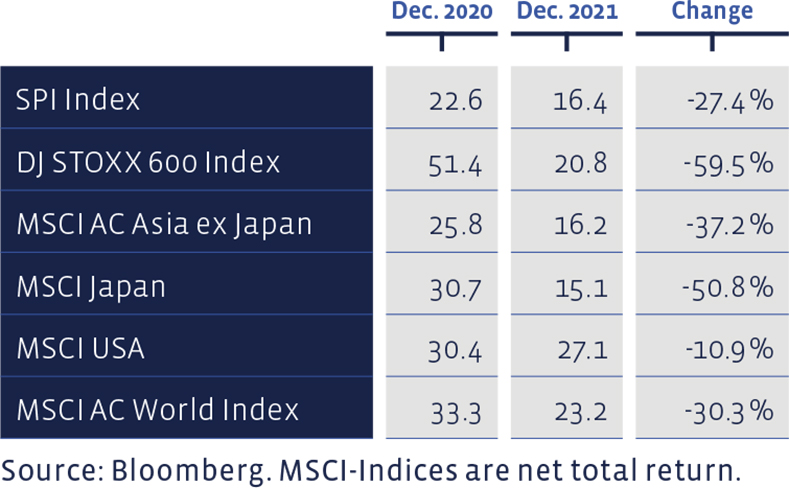

The price/earnings ratios based on the last known profits for twelve months have fallen everywhere:

Long-term, the performance of the "Swiss Stock Portfolio" is excellent. Since 2012, the average annual performance of the SSP amounts to 15.2%, which clearly exceeds the average benchmark performance of 12.3%. Since 2012, this strategy has achieved a cumulative total performance of around 297%, compared to 208% for the index. The SSP figures bear transaction costs, whereas the benchmark index does not bear any costs.

Equities Europe

European equities also benefited from a following wind. Although the broad DJ Stoxx 600 Index posted 7.6% for the last quarter, this was a slightly smaller gain than that of its Swiss counterparts. The European market was also in the top league in 2021, with an annual performance of 24.9. %. Transaction costs and withholding taxes are deducted from the ESP figures, whereas the benchmark index is calculated without costs.

Although there were some top performers in the portfolio, notably ASM International (annual performance +118%), A2A (+38%) and Ahold Delhaize (+35%), these failed to lift the overall selection above the index in terms of returns. At the other end of the list, Kindred Group (-30%) and Neste (-25%) failed to meet expectations in 2021.

The long-term ESP performance since 1992 continues to speak in favour of the value style applied in this selection. Over this period, ESP has achieved an average annual performance of 8.68%, compared to 7.33% for the benchmark. The portfolio has thus accumulated 1,114%, whereas the cumulative index performance is "only" 736%. The comparison with a reference index limited to value stocks is also interesting. In this comparison, for which we have data since 1998, the annual performance of the European Stock Portfolio amounts to 6.79%, compared to 4.59% of the benchmark. In other words, the ESP actually outperformed the value benchmark by 2.21 percentage points per year, compared to 1.35 percentage points for the overall market.

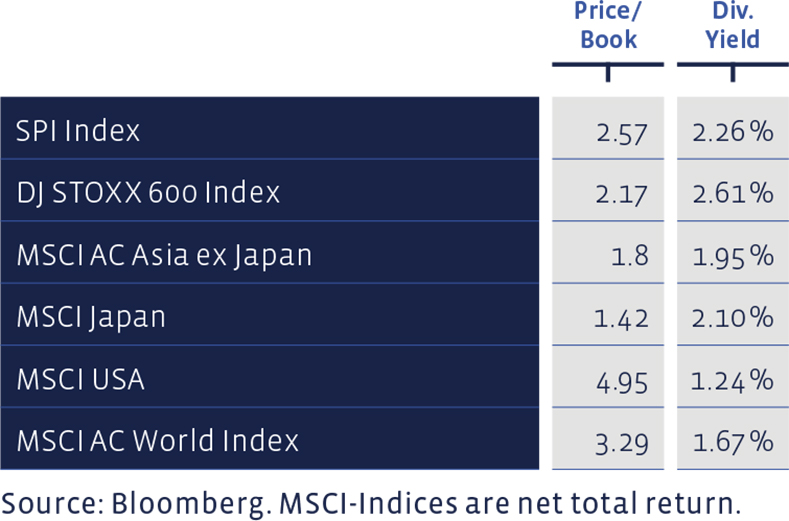

Price / Book and Dividend Yield of major equity markets:

Equities USA

There was no holding American equities back in 2021. The leading index MSCI TR USA excelled with an annual performance of 26.5%. In the fourth quarter alone, it was 10%. The Performa US Equity Fund we use crossed the finish line with a similar performance. Clients calculating in Swiss Francs and Euros also benefited from the appreciation of the US Dollar. We are slightly overweight in American equities. There were no changes in the positions in the fourth quarter.

Equities Asia (ex Japan)

The positions in Asian equities (excluding Japan) also remained unchanged. The slight overweight in the Far East also remained. The positions remained unchanged in the past quarter. However, 2021 was not the Asian stock markets' year, with negative performance values in the index both for the fourth quarter and for the year as a whole. Nevertheless, the funds we used outperformed the benchmark. The Barings Asean Frontier Markets Fund even delivered a clear double-digit increase.

Equities Japan

Contrary to the negative equity trend in the Asian emerging markets, Japan delivered good results as an established industrial nation. The leading index in the Land of the Rising Sun more or less stood still in the fourth quarter. However, in the year-end reckoning, a plus in the order of a good 13% remained. The positions remained unchanged, thus maintaining a slight overweighting.

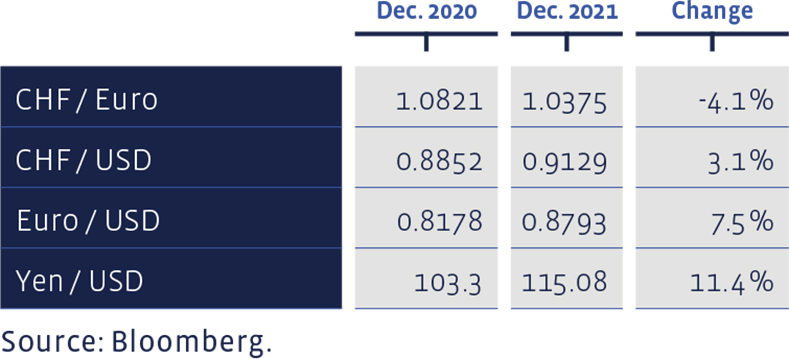

In 2021, the selected foreign exchange rates have performed as follows:

Alternative Investments

Hedge funds were unable to shake off their lethargy in the final quarter. Overall, 2021 was simply too quiet for hedge funds to really play to their strengths. Nonetheless, the BCV fund posted a gain of more than 6% in Swiss Francs and Euros, which is well above the benchmark. We did not make any changes to the positions in the fourth quarter.

Precious Metals

Apparently, Gold did not want to stay out of the spotlight during the sparkling Christmas season and showed signs of life again towards the end of the year. In Dollars, however, a loss remained for the whole year, although the higher Dollar exchange rate almost compensated this loss for investors in Francs. Investors in Euros even managed a positive performance thanks to the Greenback. We have left the positions unchanged.

Summary of our current Asset Allocation: